Before we dive in, let's cover the basics: prediction markets allow people to bet real money on future events. Whether it's who wins an election, which team takes the championship, or how the Fed will change rates, these markets tap into the wisdom of crowds to forecast outcomes.

In 2025, prediction markets have exploded in popularity, with monthly trading volumes surging past $13 billion, driven by regulatory clarity, blockchain integration, and mainstream adoption by platforms like Kalshi and Polymarket.

Now that we have the basics covered, let's get into the nitty gritty details:

What Are Modern-Day Prediction Markets?

Prediction markets, sometimes called event markets or information markets, are platforms where users trade contracts whose value depends on the outcome of future events. These contracts settle at $1 if the event happens or $0 if it doesn't. Unlike traditional gambling, prediction markets function as derivative exchanges, leveraging the efficient-market hypothesis to aggregate information and produce accurate forecasts.

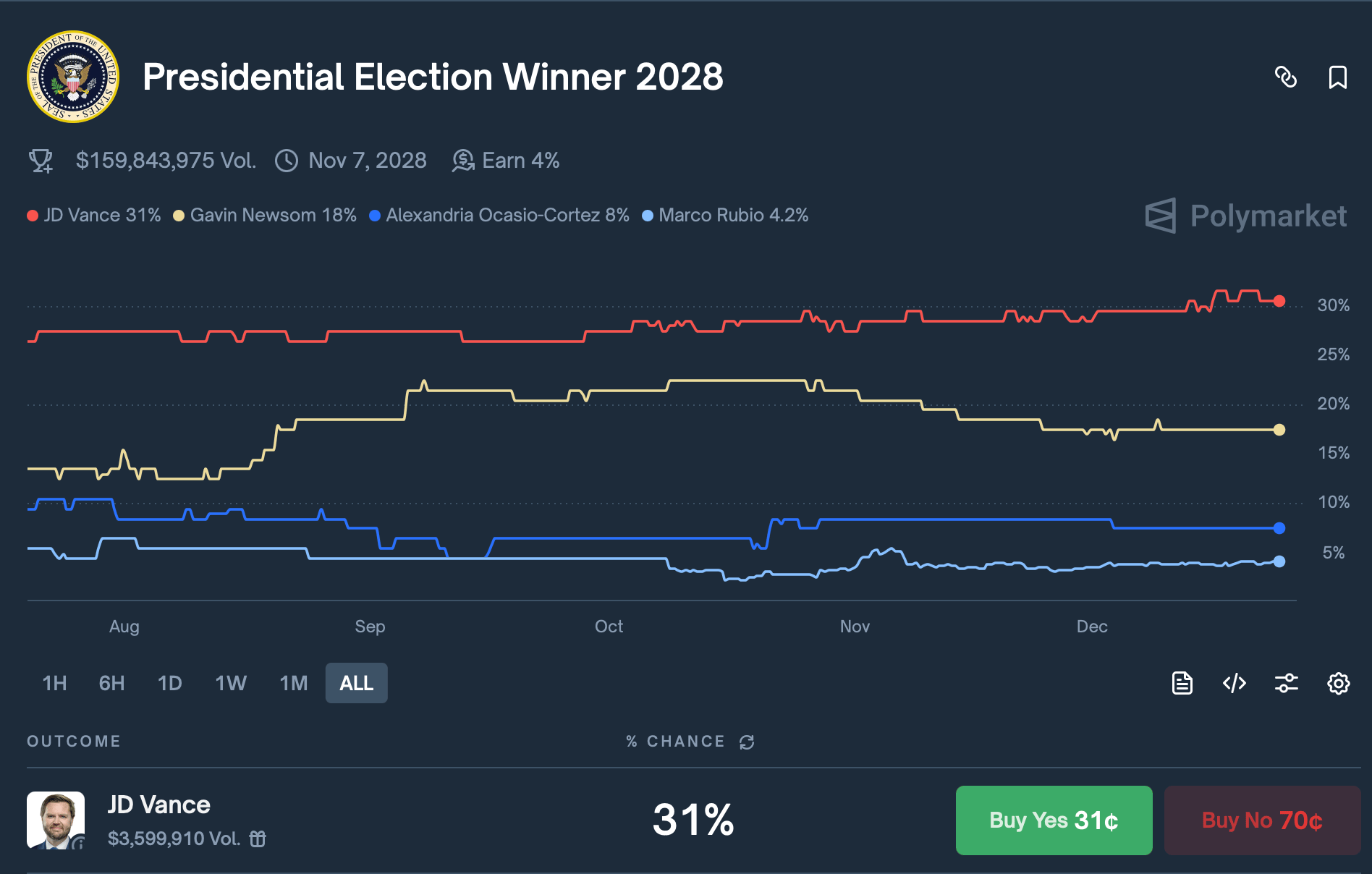

Source: Polymarket

Example: If a Polymarket contract "Will JD Vance win the 2028 US election?" is trading at $0.31, the market collectively estimates a 31% chance of him winning, based on real-money contracts that incentivize accurate predictions. In 2025, these markets have evolved to include combinatorial prediction markets, where users can bet on multiple interconnected events, enhancing forecasting for complex scenarios like company earnings or product launch dates.

A Quick History of Prediction Markets (For the Nerds)

Prediction markets aren't new. People have been betting on political outcomes for centuries, with political wagering being commonplace in the 1800s. The modern version got its start in the late 20th century with university experiments like the Iowa Electronic Markets, which proved that prediction markets could beat traditional polls at forecasting elections.

The 2000s brought platforms like Intrade, but regulators weren't fans and shut them down. Then came the crypto era. Projects like Augur launched on Ethereum, bringing prediction markets onto the blockchain.

Fast forward to 2025, and platforms like Kalshi, Polymarket, and Opinion.trade have gone mainstream with slick interfaces, regulatory compliance, and global reach.

The real turning point? A 2024 court ruling that allowed federally regulated event contract exchanges in the U.S. The result was explosive, economics markets alone grew 905% to $112 million. Meanwhile, innovations like reputation-based prediction markets and Bayesian networks transformed these platforms from betting sites into legitimate forecasting tools for science and tech.

Trump's involvement and multi-billion-dollar valuations pushed things into overdrive in 2025. Partnerships like Robinhood integrating with Kalshi blurred the line between investing and betting. And as of 2025, even the CFTC is taking notice, hosting roundtables to figure out how to regulate this space properly.

Now that you know the history, let's get into how these markets work...

How Do Prediction Markets Actually Work?

At their core, prediction markets use event contracts, financial instruments that pay out if a specific thing happens. You're buying and selling "Yes" or "No" shares on real-world events, and the price of those shares tells you what the crowd thinks will happen.

What Can You Bet On?

Pretty much anything with a clear outcome:

Elections ("Will Candidate X win?")

Economic indicators ("Will inflation exceed 3%?")

Sports results ("Will Team A win the championship?")

Weather events, award shows, and more

The Basic Mechanics

Here's how the money works: Every contract trades between $0 and $1. If your prediction is right, you get $1 per contract. If you're wrong, you lose what you paid.

The clever part? The price is the probability. A contract trading at $0.40 means the market thinks there's a 40% chance it happens. As new information comes in, those prices update in real-time through mechanisms like probability updating and information aggregation.

Let's Walk Through an Actual Trade

Say you're looking at: "Will unemployment fall below 4% this quarter?"

Step 1: The “Yes” contracts are trading at $0.60 (meaning the market thinks there's a 60% chance).

Step 2: You've done your homework and think it's way more likely than that, so $0.60 looks like a steal. You consider factors like potential market manipulation risks or speculative bubbles.

Step 3: You buy 50 "Yes" contracts for $30 total ($0.60 × 50).

Step 4: Now you wait. When the unemployment numbers drop:

If you're right and unemployment falls below 4%, you get $50 (your 50 contracts × $1 each). That's a $20 profit.

If you're wrong, those contracts are worthless and you're out $30.

The beauty of prediction markets is that they update constantly as new data comes in, way faster than polls or expert forecasts can adjust. They respond to information that may not yet be visible in traditional polling.

Why Prediction Markets Matter

Crowd-based forecasting: They aggregate diverse information, turning the collective knowledge of thousands into a single, real-time probability, often more accurate than expert predictions.

Real-time signals: Prices update continuously, reflecting the latest news and sentiment, making them vital for forecasting areas like Fed rate decisions.

Decision-making and hedging: Businesses, investors, and policymakers use these markets to manage risk and inform strategy. Companies even run internal markets to forecast project outcomes or sales.

In 2025, their industry impact spans:

Financial services for hedging economic risks

Gaming through integration with fantasy sports platforms

Derivatives via combinatorial prediction markets

Healthcare and research, where the Prediction Market Industry Association advocates for their use in clinical trials and drug R&D to predict study replications or policy effects

Who Uses Prediction Markets?

Individual traders seeking profit by forecasting events

Researchers studying collective intelligence and probability estimation

Businesses using internal markets to forecast project outcomes, sales, or product launch dates

Institutional investors monitoring for insights into political or economic risk

Media and analysts citing prediction markets as alternative indicators to polls

Policymakers exploring them for forecasting disease outbreaks or policy impacts, with growing use in public health and scientific forecasting

Major Platforms in 2025

Kalshi: CFTC-regulated (US), uses USD, focuses on politics, economics, weather. Best for US-based users wanting regulatory compliance.

Polymarket: Re-entered US market in 2025 after years offshore, uses USDC stablecoin on Polygon chain, covers politics, sports, finance. Best for international and crypto users.

OPINION: Backed by Binance and it’s founder, uses USDT stablecoin on BNB chain, popular overseas, grown to be a top platform in less than a year

Manifold Markets: Play-money using Mana (virtual currency), focuses on tech, AI, community questions. Best for practice with no financial risk.

Limitless: On Coinbase’s Base blockchain, designed to simplify trading in crypto and stocks

Others: Brokerage apps like Robinhood Predictions (CFTC via partner, USD, sports/politics), crypto apps like Crypto.com (USDC, sports), traditional sportsbooks like Fanduel Predicts, and peer-to-peer platforms like Novig.

Regulation and Taxation

US Regulation

The Commodity Futures Trading Commission (CFTC) oversees prediction markets that resemble derivatives under the Commodity Exchange Act. Some platforms (like Kalshi) are fully regulated; others (like PredictIt) operate under research exemptions.

In 2025, a court ruling enabled federally regulated event contract exchanges, but state rules often treat them as gaming, adding restrictions and surveillance frameworks. Offshore operations face compliance challenges, with sports betting under particular scrutiny from state regulators.

The Commodity Exchange Act prohibits CFTC licensees from trading contracts involving gaming or events contrary to the public interest, leading to ongoing debates. Groups like the American Gaming Association have campaigned against prediction markets, while the NFL has warned against approving sports-related event contracts, citing risks to game integrity.

As of December 2025, the CFTC approved final rules revising swap dealer requirements and greenlit Polymarket's return to US operations. This has spurred acquisitions by major finance and sports betting firms, while lawsuits like Coinbase's against Michigan, Illinois, and Connecticut challenge state-level restrictions.

Globally, regulations vary widely, with some countries viewing them as gambling, requiring careful compliance for offshore operations.

Tax Treatment

The basics: Winnings are generally taxed as ordinary income, with short-term capital gains tax rates up to 37% for holdings under a year.

The advantage: CFTC-regulated event contracts may qualify for favorable Section 1256 treatment under the 60/40 rule (60% long-term capital gains at lower rates up to 20%, 40% short-term). This offers significant tax advantages over traditional gambling or sports betting, where winnings are ordinary income and losses are only deductible up to gains.

Additional details:

Deduct up to $3,000 in losses annually against ordinary income

Report via 1099-MISC forms or W-2G for larger amounts

The trading vs. gambling distinction is crucial for tax treatment

Federal excise tax on wagers may apply if classified as gambling

State tax treatment varies

The 2025 tax code updates position prediction markets as a potentially tax-efficient alternative, though uncertainty remains around sports events futures contracts taxation. Consult a tax professional for your specific situation.

Common Myths & FAQs

Myth: Prediction markets are just gambling.

Fact: While there's risk, prediction markets are used for information aggregation, not just entertainment or luck.

Myth: They're always accurate.

Fact: Markets reflect probabilities, not certainties. Surprises and errors can and do happen.

Myth: They're illegal everywhere.

Fact: Legal status varies by platform and location; some are fully regulated under the CFTC.

Myth: Only experts can win.

Fact: Anyone can participate; expertise helps, but so does staying informed.

Risks and Limitations

Low liquidity: Some markets have few traders, making prices volatile with wide bid-ask spreads. This complicates hedging without underlying assets. 2025 saw emerging liquidity crises in crypto-linked prediction markets, straining systems amid high volumes.

Manipulation: Large traders can temporarily skew prices, especially in thin markets, leading to market distortion and speculative bubbles. Examples include suspected wash trading and pump-and-dump schemes in 2025 crypto prediction markets, artificially inflating volumes.

Regulatory uncertainty: Legal and tax status can change, affecting access, with risks of regulatory and legal consequences from federal-state clashes.

Behavioral biases: Herd mentality and overconfidence can distort probabilities.

Specialized knowledge: Some events require expertise for accurate forecasting.

Additional challenges:

Addiction: Prediction markets add to the gambling landscape where anyone can develop dependency similar to sports betting

Combinatorial complexity: Advanced markets can be difficult to understand

Margin requirements: Can amplify losses

MNPI misuse: Employees or insiders exploiting sensitive information remains a high compliance risk in 2025, with SEC scrutiny on credit markets and AI-driven trading strategies potentially enabling manipulation

In 2025, scandals highlighted risks like liquidity gaps, ethical concerns, and surveillance challenges in maintaining market integrity, including top compliance issues like monitoring for manipulation and consumer protection.

Tips for Managing Risk

Start with small amounts

Diversify across different markets

Use reputable, regulated platforms with risk models

Track your trades and performance

Stay informed about the events you're trading

Use Cases Beyond Trading

Scientific forecasting: Predicting which studies will replicate in clinical trials

Corporate strategy: Aggregating employee insights on project timelines or company earnings

Public health: Forecasting disease outbreaks or policy effects

Media analysis: Supplementing polls with market-based probabilities

Geopolitical: Betting on international outcomes, with rising use in 2025 for real-time signals

The Future of Prediction Markets

Prediction markets are gaining traction as tools for forecasting, risk management, and collective intelligence. As technology, regulation, and user adoption improve—with 2025 volumes exceeding $13 billion monthly—they could become a standard part of financial and decision-making infrastructure, potentially reaching $1T scale by 2030 amid AI enhancements and broader integration.

Ready to Get Started?

Pick a platform that fits your needs and location

Learn the rules and start with small trades

Track your results and keep learning

Explore prediction markets as a way to forecast, hedge, and participate in the future of information markets

Bottom Line: Prediction markets are powerful, crowd-driven tools for turning collective knowledge into actionable forecasts. They offer unique opportunities and unique risks as they become a bigger part of finance, research, and everyday decision-making in 2025 and beyond.