GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

💴 Polymarket has become the exclusive prediction market partner of the Wall Street Journal and the Dow Jones

❌ Polymarket moves the goalposts to save $$$

🚀 A new prediction market just crossed $1M in revenue

📈 Market Moves

📊 Odds & Ends

POLYMARKET PARTNERS WITH THE WALL STREET JOURNAL 💴

Polymarket just became the exclusive prediction market partner of The Wall Street Journal and Dow Jones. That sentence still feels a bit surreal to type.

Under the partnership, Polymarket data will appear across WSJ, Barron's, MarketWatch, and Investor's Business Daily. Dedicated modules will display real-time betting odds on economic, political, and cultural topics - on homepages, market pages, and select print placements.

The most interesting piece is a custom earnings calendar showing market-implied expectations for corporate performance. That puts prediction markets on the same shelf as analyst estimates and price targets. Polymarket data will sit right alongside the traditional indicators that investors have relied on for decades.

And this isn't happening in isolation. CNBC signed a multi-year deal to integrate Kalshi probabilities into their TV and digital coverage, complete with a dedicated ticker. Google's policy update allowing prediction market ads goes live January 21.

I've been watching prediction markets for a while now, and this kind of week would've seemed implausible even a year ago. The Dow Jones is about as establishment as financial media gets. Prediction markets are officially a Wall Street-recognized asset class now.

POLYMARKET WON’T PAY UP ❌

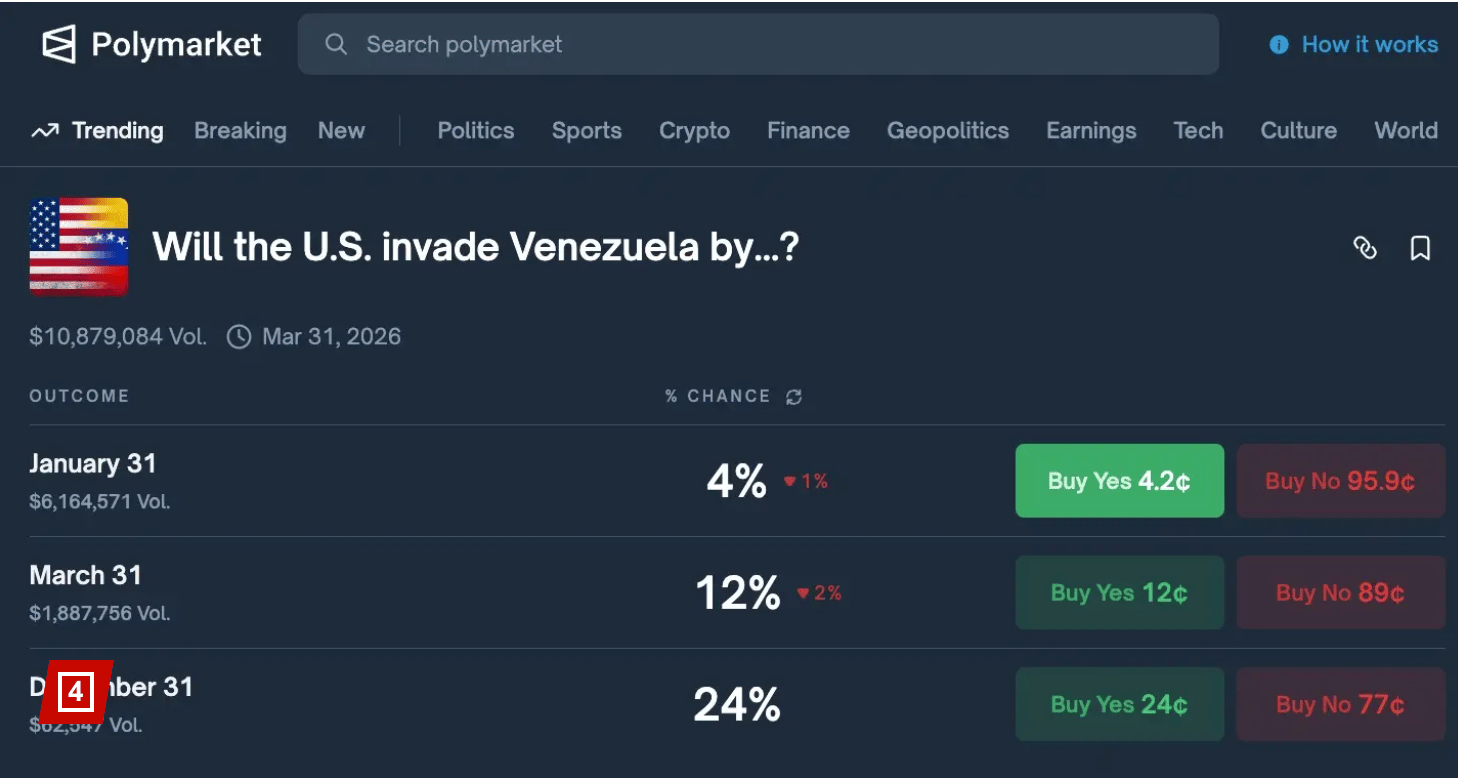

You thought Wall Street was wild? Try throwing geopolitics into a digital casino built on crypto, ambiguity, and “What constitutes an invasion?” as the house rule.

This week’s weirdest headline reads like performance art: “Polymarket, a prediction market where you bet on world events, has refused to pay folks who wagered that the U.S. would invade Venezuela.” In their official interpretation, the dramatic raid that captured Nicolás Maduro doesn’t count as an invasion unless U.S. forces actually establish control over Venezuelan territory. It doesn’t make sense to us either.

Traders are livid. One poster basically asked, “So if the U.S. used a teleportation device to snatch Maduro and flew home, THAT would be an invasion?” That sums it up: the fight here isn’t about geopolitics, it’s about semantics-judo and contract fine print gone berserk.

There’s more. Polymarket did pay out big on a related bet: the one trader who apparently made about $400,000 off a wager that Maduro would be removed from power before the end of January, and they put that bet on just hours before the U.S. strikes unfolded. Suspicious timing? Check. Insider trading chatter? You bet. Congressional curiosity? Also check. Lawmakers are now talking about banning officials from predicting the future for money.

Suddenly, we’re in a world where real international conflict and crypto betting markets are tangled like earbuds in a pocket. Prediction markets are destined to be clever crowd forecasts, but right now, they’re clocks, casinos, and moral Rorschach tests all at once.

The real punchline: Polymarket still lists the odds of a U.S. invasion by the end of January, and they’re still tiny. But what’s tiny compared to the colossal existential question the internet now faces: Does capturing a dictator count as invading a country if we’re talking about users’ money?

Welcome to 2026, where geopolitical drama is live-traded, reality is a contract dispute, and nobody can agree on the definition of “invasion,” except Polymarket.

THE NEW KID ON THE BLOCK 🚀

The prediction markets space reminds me of crypto in 2022. Projects were launching every week. Most disappeared. A few stuck around and kept building through the noise.

Limitless is one of them.

While everyone’s obsessing over Polymarket’s real estate markets and Kalshi’s regulatory battles, Limitless just quietly crossed $1M in revenue. They’re currently running at a $4M annual revenue rate based on December fees alone.

Most people haven’t heard of them. So let’s explain.

Source: Limitless

Limitless isn't trying to be Polymarket. Different game entirely…at least for right now.

Polymarket primarily is known for long-term events, such as elections, geopolitics, macro outcomes that unfold over weeks or months. Success there comes from research, information flow, and understanding narratives.

Limitless focuses on short-term, high-frequency markets. Prices move in minutes, sometimes seconds. Think markets such as "Will BTC be up in the next 15 minutes?" not "Will Trump win the election?"

The platform is built on Coinbase’s Base blockchain to maximize speed, with advanced order types like limit orders, stop-losses, and conditional trades. The matching engine is designed to minimize slippage and execute trades efficiently. They also built out social trading features where you can copy successful traders' strategies and follow their moves. The mobile app actually works well, supports multiple currencies, and includes real-time analytics dashboards.

The crazy part is Limitless was only founded two years ago. Compare that to Kalshi and Polymarket, both of which were started before 2020.

The prediction markets space is still early with lots of platforms launching. Most will die. However, a few will survive and compound.

Limitless is doing $4M annually while barely anyone knows they exist. No massive PR push. No celebrity advisory boards. Just building product and growing revenue.

The platforms that survive the next two years, the ones that keep building through regulatory uncertainty, market downturns, and hype cycles, those are the ones that matter.

Limitless isn't the loudest. But they're still here. Revenue's growing. Product's improving. That counts for something.

MARKET MOVES 📈

Metric | Market |

Biggest swing | "Will Alphabet be the second-largest company in the world by market cap on Jan 31" moved 28% → 59% (Polymarket) |

Top earner | @gmanas - $420k 24H profit (Polymarket) |

Weirdest market with volume | "How many large volcano eruptions (VEI ≥4) in 2026?" - $97k total volume (Polymarket) |

ODDS & ENDS 📊

Social prediction games enter the market

Tradefox, a popular prediction markets trade terminal aggregator, crossed over 1M trades.

Polymarket on track to overtake most popular Solana token launcher Pump.fun in daily volume in days.

RATE TODAY’S EDITION

What'd you think of today's edition?