GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🏛️ The President's son has a seat at every table

🥷 Prediction markets’ Jordan Belfort executes scheme

🎰 Robinhood adds parlays to prediction markets (sort of)

📈 Market Moves

📊 Odds & Ends

DONALD TRUMP JR ADVISES BOTH POLYMARKET AND KALSHI WHILE LAUNCHING TRUTH PREDICT 🏛️

Donald Trump Jr. is an investor in Polymarket. He's also a paid advisor to Kalshi. These two companies are direct competitors fighting for the same traders, the same volume, the same market. And somehow, the president's son is in the ear of both. He's also a director at Trump Media, which just announced it's launching Truth Predict. Three prediction market plays, one family.

Let's walk through the timeline. Kalshi hired Don Jr. a week before Trump's inauguration. Four months later, the CFTC dropped its appeal of a case it had been fighting since 2023. Polymarket also announced Don Jr.'s advisory role in August. A week later, the CFTC issued a ruling that cleared the path for its U.S. expansion. Both companies' CEOs now sit on the CFTC's innovation council.

Kalshi says Don Jr. had nothing to do with any of it. Polymarket's Shayne Coplan was more direct when asked why he brought on the president's son. He told 60 Minutes he needed help "navigating the Trump administration." At least he's honest.

Then there's the insider trading problem. Someone turned $34,000 into $410,000 betting on Maduro's ouster, most of it wagered hours before the news broke, from a brand-new account. The CFTC is supposed to police this, but former chair Timothy Massad says the law is too vague to enforce.

Truth Predict is coming next. Trump Media says it will let Truth Social users trade on sports, inflation, interest rates, and commodities. Don Jr. earned $813,000 from the company last year and oversees his father's majority stake as sole trustee. He says he wasn't involved in the decision to launch. His spokesman calls the scrutiny "baseless innuendo." But when Truth Predict goes live, one family will have a hand in every major prediction market in the country.

RETAIL TRADER RUNS ELABORATE MARKET HEIST 🥷

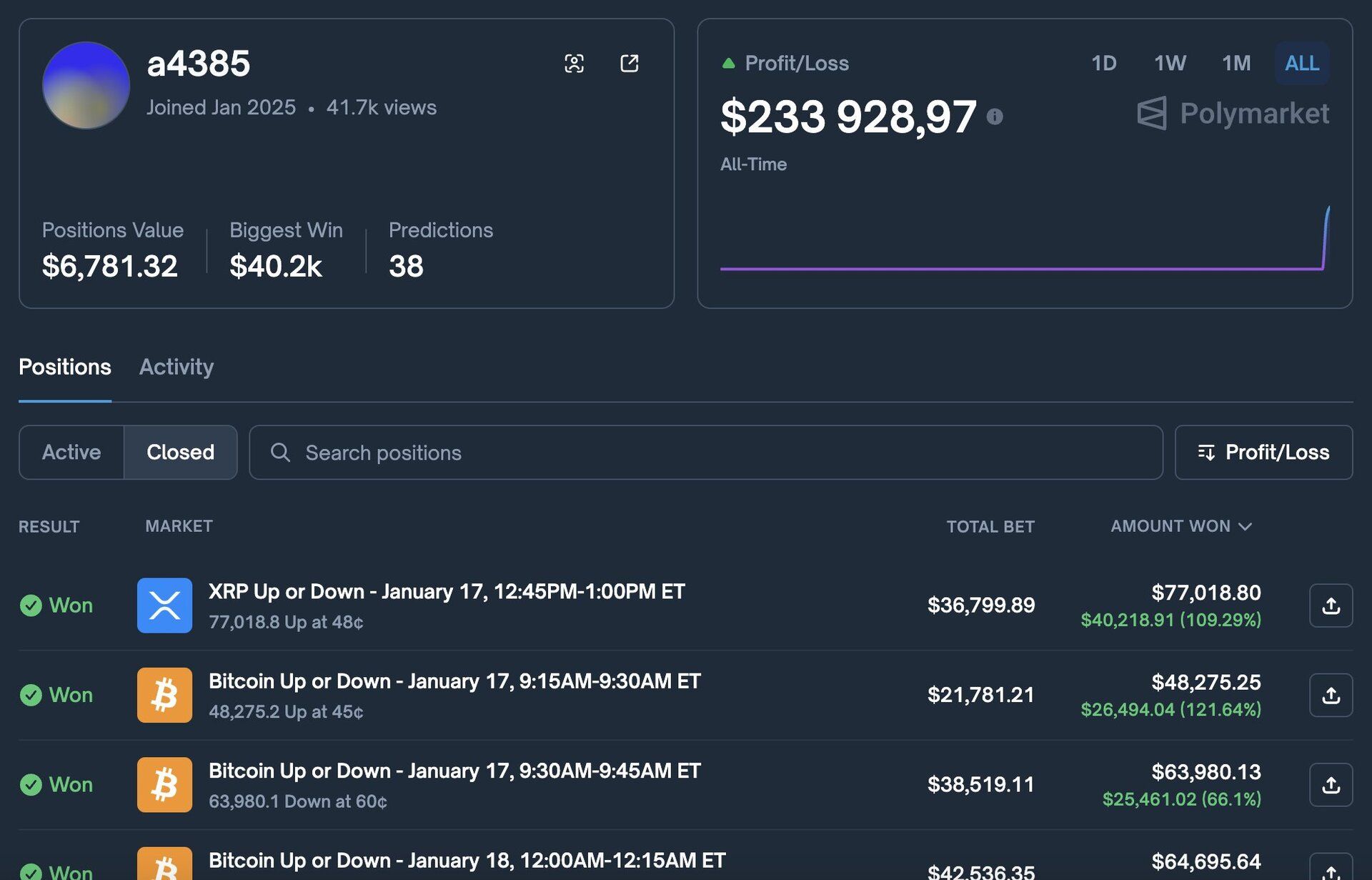

A Polymarket trader quietly pulled off a textbook liquidity heist this weekend, walking away with $233k before most people even realized anything had happened.

The trade targeted fifteen minute crypto markets late Saturday night. Liquidity was thin, attention was low, and most of the volume came from automated trading bots that assumed price movement meant information.

On an XRP UP or DOWN contract, the trader aggressively bought UP at any price, pushing it as high as 70 cents even while XRP itself drifted lower, which convinced the bots that the market was mispriced. This led them to sell him more and more UP.

By the time the trap was set, he had accumulated roughly $77k UP shares at an average price near 48 cents, entirely supplied by bots that mistook manipulation for signal.

Two minutes before settlement, a one million dollar spot buy on Binance nudged XRP just high enough to flip the outcome, after which the spot position was immediately unwound.

The cost of moving the market was only a few thousand dollars while the payout from Polymarket cleared well over two hundred thousand.

He repeated the play across similar markets, draining bot wallets that never adjusted, with at least one bot giving back an entire year of profits in a single night.

No exotic technology was required, only timing, thin liquidity, and the realization that bots cannot tell the difference between conviction and a shove. One can only wonder how much more opportunity there is to conduct schemes like this in unregulated markets.

Man finally took down machine.

ROBINHOOD DISCOVERS PARLAYS 🎰

Robinhood just rolled out "Custom Combos," letting users bundle up to 10 NFL prediction contracts into a single wager. While these look and feel like the parlays driving growth for sportsbooks like DraftKings and FanDuel, the company insists they are technically different.

Instead of a "house" setting odds, prices are determined by market makers via Kalshi's request-for-quote (RFQ) system. A spokesperson told Decrypt that "any participant... can submit a quote" to take the other side, differentiating the product from traditional sports betting mechanics where the operator sets the price.

The move leverages Robinhood's fastest-growing revenue line, with over 1 million users trading 11 billion contracts since late 2024. This specific feature is live for the NFL postseason in most states, excluding Maryland, Nevada, and a few others where prediction markets face tighter restrictions.

Regulatory pressure remains the wild card. While federal courts have leaned in favor of markets like Kalshi, state regulators in Connecticut and Tennessee are actively fighting back with cease-and-desist orders against prediction market operators.

Robinhood previewed combos at its December YES/NO event, along with plans to expand player contracts to other sports. For now, it's NFL-only. The pricing question - whether prediction market combos can compete with traditional sportsbook odds - remains open.

MARKET MOVES 📈

📈 Biggest swing: “Will João Cotrim de Figueiredo vote share in Portuguese presidential first round hit 16-18%?” moved 17% → 91% (Polymarket)

💰 Top earner: @0x492442eab586f242b53bda933fd5de859c8a3782 - $781,065 24H Profit (Polymarket)

🤔 Weirdest market: “Jacob Elordi and Olivia Jade confirmed relationship by June 30?” (Polymarket)

ODDS & ENDS 📊

Kalshi hits ATH with $500M+ daily volume. Combos volume also set a record at $98M. Football and basketball drove over $400M of the action.

Polymarket waited for X to break the news, with markets stalling for more than two minutes after President Trump stated he wants Hasset “in his current role”, largely due to X experiencing downtime during the announcement.

Crypto markets take long-weekend nosedive.

RATE TODAY’S EDITION

What'd you think of today's edition?

MEME OF THE DAY 😂

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd