Happy New Year. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🏎️ Fintech Giants square off in race for new markets

🔒 Crypto wants privacy. Prediction markets aren't there yet

🏜️ Behind record-breaking activity lies a graveyard of dead markets

📈 Market Movers

📊 Our 2026 predictions

ROBINHOOD TAKES LEAD IN PREDICTION MARKETS AS COINBASE PLAYS CATCH-UP 🏎️

The prediction markets race is on for fintech giants Robinhood and Coinbase, and Robinhood has an early lead.

Robinhood moved first on regulated event contracts: elections, sports, real-world outcomes. They focused on this as a core product as opposed to a side experiment. Management now says it’s the fastest-growing revenue line in company history. Since launching last year, users have traded $11B in contracts.

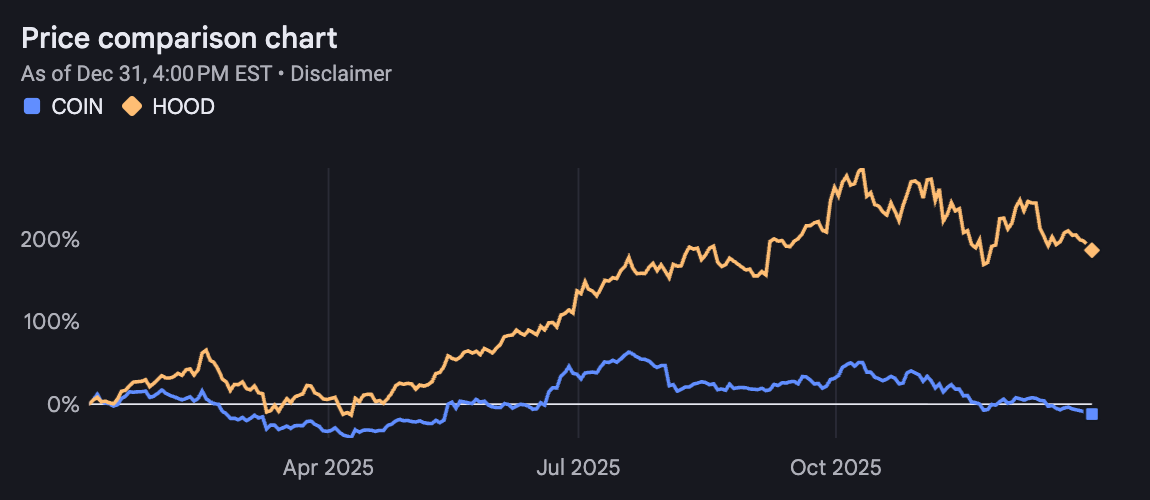

The scoreboard tells the story. Robinhood is up over 200% this year. Coinbase is in the red. The difference isn’t vibes; it’s timing and structure.

That didn’t happen by accident.

Robinhood took a majority stake in LedgerX, giving them a compliant clearinghouse without fully absorbing the operational drag. Coinbase went the opposite direction, buying a prediction markets clearing firm outright, staffed with veterans from Polymarket and Kalshi. Strong team, heavier lift.

This is a classic speed vs. control tradeoff. So far, speed is winning.

Prediction markets are a liquidity game. The venue that gets flow first tightens spreads, improves price discovery, and becomes the default. Robinhood’s retail distribution gives them a built-in liquidity engine. Coinbase is still spinning the flywheel.

The real prize is ahead. As the CFTC takes a more innovation-friendly stance under the new administration, the race shifts from “can this exist?” to “who can scale it best?”

Deeper liquidity. Cleaner settlement. Faster iteration.

Robinhood has the lead, but the race is on.

ONCHAIN PRIVACY EMERGES AS CRYPTO’S NEXT BIG NARRATIVE. WILL PREDICTION MARKETS JOIN IN? 🔒

If you've been on Crypto Twitter lately, you've noticed it's hard to scroll without seeing someone hype up onchain privacy as the next major trend for 2026.

And if you're wondering why, just take a look at Zcash. It's 2025's best-performing crypto asset YTD. The price is up 4x since Naval tweeted about it in October.

But hold on. We were told the whole point of the blockchain was transparency.

I was confused as well. Let me explain.

The case for onchain privacy: As we know, every transaction is traceable and every wallet is visible on Bitcoin, Ethereum, and Solana. If governments decide to seize assets or blacklist addresses, there's not much place to hide. Zcash offers an alternative: Bitcoin's tokenomics with built-in privacy, which acts as a hedge against black swan events where traceability becomes a liability.

But this isn't just about Zcash. The demand for privacy is spreading to Ethereum, Solana, and everywhere else people transact onchain.

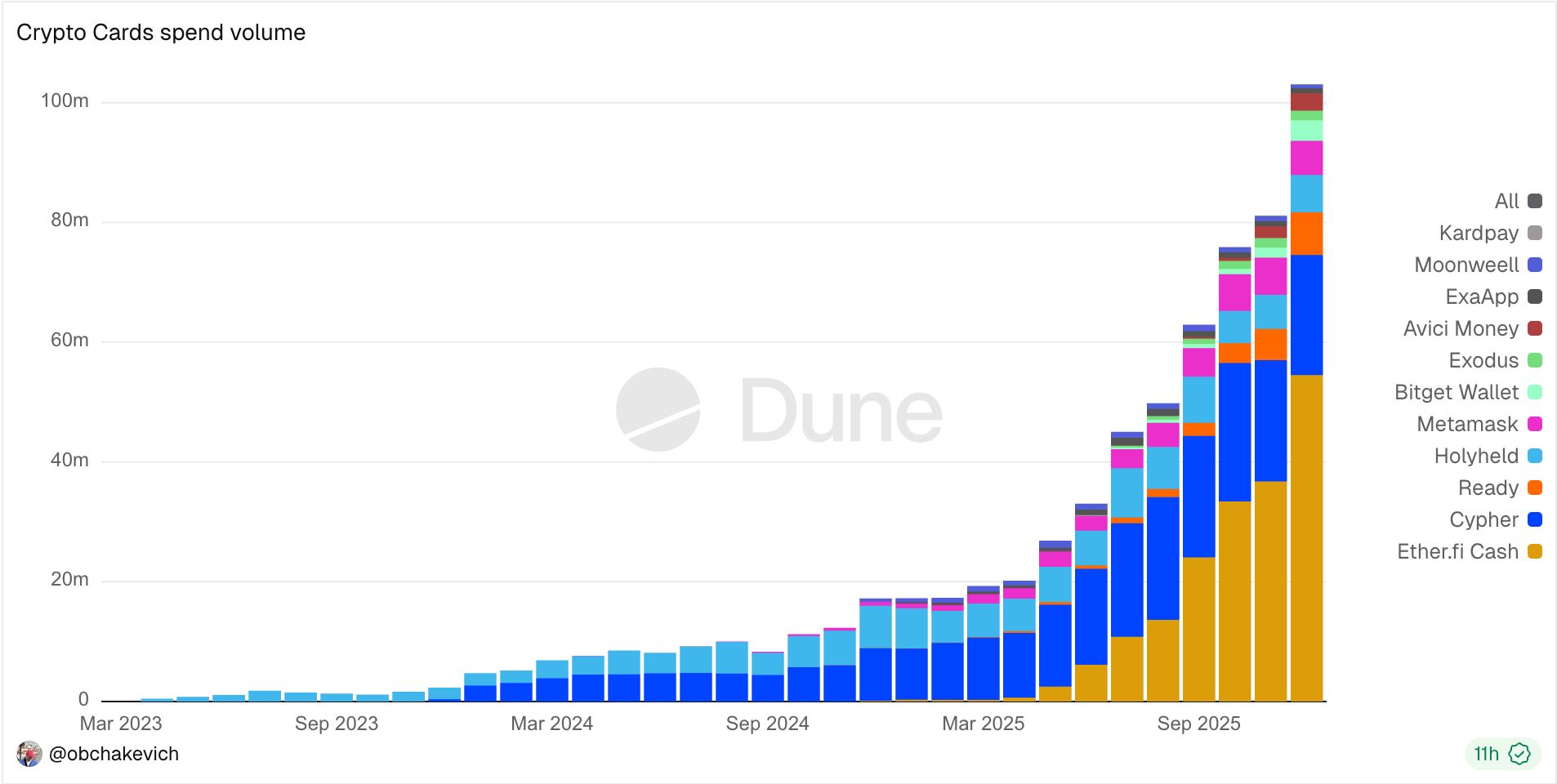

Take crypto credit cards, for example. Ether.fi's card has done $50M in spend volume this month alone. You swipe, and USDC leaves your wallet instantly to pay for your coffee, groceries, whatever. Here's the thing though: every purchase lives onchain. Do you really want the entire world seeing that you spent $68 at Popeyes last Saturday?

Probably not. And thus that’s exactly why companies like Zama are building privacy layers for blockchains like Ethereum, using techniques like Fully Homomorphic Encryption to keep your transactions private without leaving the network.

Here's where it gets interesting for us.

Many traders on Polymarket and other platforms have edge: alpha strategies, arbitrage bots, insider reads on markets. Right now, every trade is visible. Anyone can copy trade you. The more successful you are, the more eyes on your wallet, and the faster your edge potentially erodes.

Privacy would change that by anonymizing and privatizing trade activity per user.

However, there's a major tradeoff.

Transparency is also what makes Polymarket powerful. For example, when trades are public, the crowd can spot insiders and discover new trading strategies. In other words, information is democratized as everyone sees the same thing.

Compare that to Kalshi. Their exchange isn't fully onchain. Trades are private by default unless they expose them via API, which sounds great until you realize: Kalshi can see everything, but you can't. If insider trading happens, only Kalshi knows.

My take: I'm in favor of full transparency for prediction markets, the way Polymarket does it now as no platform itself has more information than anyone else. The playing field is level.

Still, onchain privacy is coming whether we like it or not. Most people want their transactions private. The technology is maturing. And eventually, prediction markets will have to decide which side of the tradeoff they're on in 2026.

BILLIONS IN VOLUME, BUT WHERE’S THE LIQUIDITY? 🏜️

Go to Polymarket or Kalshi right now. Filter by "Newest."

You'll find dozens of markets with $0 in volume and resolution dates weeks or months away. Ghost towns. Nobody wants to be first. Liquidity providers would rather park their money somewhere with faster returns. And traders don’t want to be the first ones to decide the initial bid-ask spread. It's a classic cold-start problem, and it's everywhere.

To be clear, prediction markets work. Just not most prediction markets. The reason: despite billions of dollars in weekly activity, volume remains concentrated in a handful of high-profile contracts such as deciding the Super Bowl winner or presidential elections. As a result, many other markets are plagued by wide spreads, uninformative prices, and the promise of an information economy drifting off course.

Research out of Columbia confirms what most traders already know: liquidity and accuracy are tightly linked. Even detailed market specifications can't guarantee that anyone will show up to trade.

In a response to combat this liquidity issue, many prediction market platforms are forced to partner with institutional market makers. For example, Kalshi has gone on to partner with quant trading firms Susquehanna International Group (SIG) and Jump Trading for this very reason.

Our recent analysis of A16Z's crypto outlook for 2026 touched on a future where prediction markets go hyper-niche. Some of their proposed solutions, like LLM-based resolution and AI agents trading markets have real potential to further address these issues.

But the deeper insight may be: the next phase of prediction markets isn't about listing more contracts. It's about figuring out which contracts deserve to exist at all.

MARKET MOVES 📈

Metric | Market |

Biggest swing | "Will SZA release a new song in 2025" moved 1% → 100% (Polymarket) |

Most traded | "Who will die in Stranger Things Season 5" - $4M total volume (Polymarket) |

Weirdest market with volume | "Trump to be confirmed Satoshi by December 31" - $193k total volume (Polymarket) |

2026 PREDICTIONS 📊

2026 is finally here. Time to make some predictions of our own for the upcoming year:

The “AI Counsel” pioneered by Opinion goes mainstream, which allows for faster market resolution. Kalshi and Polymarket adopt the same structure

At least one major prediction market or sportsbook gets shut down in the U.S. due to legal scrutiny

CFTC introduces formal guidance for event contracts and financial outcomes, leading to more institutional participation and deeper liquidity

RATE TODAY’S EDITION

What'd you think of today's edition?

MEME OF THE DAY 😂