GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

🎬 Polymarket becomes Golden Globes' official prediction markets partner

💵 Your prediction market bets are wasting money

💰 Big Short trader finds new investing tool

📈 Market Moves

📊 Odds & Ends

HOLLYWOOD BETS ON POLYMARKET 🎬

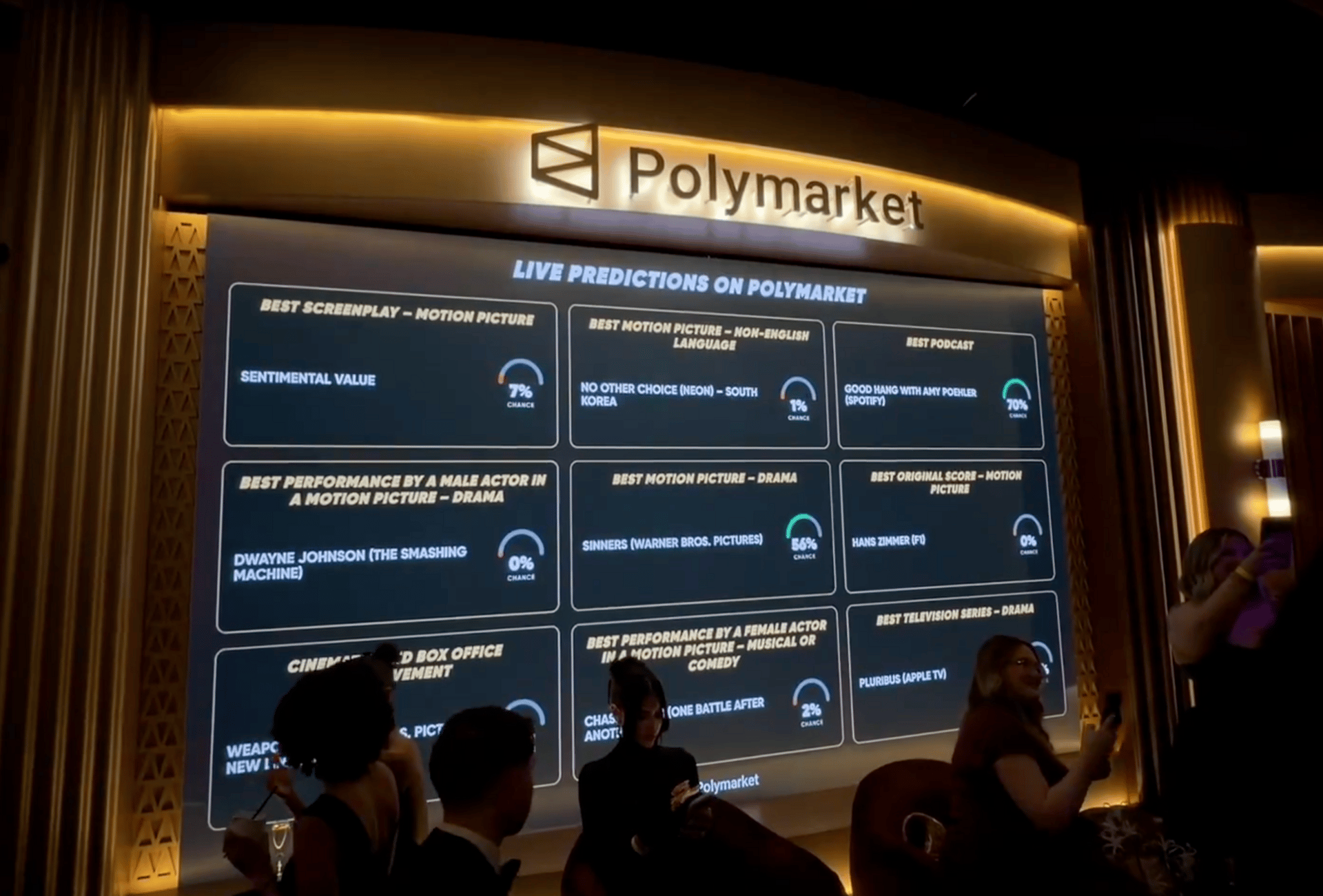

Yesterday, the world witnessed Polymarket as the "exclusive prediction market partner" of the Golden Globes. The deal, announced Friday ahead of the ceremony, makes the Golden Globes the first awards show to feature live prediction markets data at its official viewing party.

It's part of a broader push to turn market odds into content. Earlier this week, the Dow Jones announced it would integrate Polymarket data across the WSJ, Barron's, and MarketWatch. CNBC has a similar arrangement with Kalshi. Now entertainment is getting the same treatment. Penske Media, which owns the Golden Globes, is calling it a "groundbreaking new frontier" in audience engagement.

One wrinkle: Polymarket still geoblocks US users from placing orders. So viewers last night watched odds move in real time, but many couldn’t actually trade on them.

Source: Golden Globes

Critics raised insider-trading concerns before the broadcast. Awards are decided in closed rooms by known voters, a setup that's generated controversy before, and now has real money attached. Gizmodo calls it "tailor-made for insider trading." The A.V. Club is going with "bringing gambling to award season."

What's interesting is that Polymarket didn't need to cut this deal for exposure. They're already everywhere. Rather, we think the Golden Globes needed Polymarket more than Polymarket needed them as live odds create engagement, drive conversation, and give viewers something to track beyond who's wearing what. If awards shows want to stay relevant, attaching real-time probability to outcomes isn't a bad move. Even if most viewers still can't trade.

PREDICTION MARKETS HAVE A PROBLEM. DEFI MIGHT FIX IT 💵

Here's something most people don't think about: when you bet on prediction markets, your money just sits there doing nothing until the market resolves.

Buy $10,000 worth of shares at 80¢ on a market that resolves in a year? That $10,000 is locked. Can't earn yield. Can't be deployed elsewhere. Just frozen until resolution.

If the market resolves in your favor, you make $2,500. Not bad. But you just gave up a year of potential returns on that $10,000 to make 1.25x.

According to Predict.fun's research, there's over $680 million in capital stuck like this across prediction markets. Money that could be working but isn't.

In the era of DeFi, that's absurd. And some platforms are starting to fix it.

Predict.fun, one of the fastest growing prediction market platforms rivaling Polymarket and Kalshi, just partnered with Venus, a BNB-based lending protocol with nearly $300 million in USDT liquidity. The idea is simple: when you open a position on Predict.fun's short-term markets, your collateral automatically gets deposited into Venus to earn yield.

Your capital still backs your position, but now it's generating returns while you wait for resolution. Predict.fun already has about $6 million staked, making up roughly 2% of Venus's USDT market.

They're starting with short-term markets and plan to expand to all positions. Eventually, users will be able to claim their yield directly.

But it goes further. Predict.fun is working toward letting users borrow against their positions to open new trades (creating synthetic leverage) or deploy capital into liquidity pools. Your prediction market position becomes collateral for additional moves.

We're in the early days of DeFi apps built on top of prediction markets. Most platforms haven't figured this out yet.

Gondor.fi is another example. They're enabling borrowing against Polymarket positions via Morpho, a lending protocol. You hold shares in a market that won't resolve for months? Instead of waiting, you can borrow against those shares and deploy that capital elsewhere.

Same concept: unlock trapped capital. Make prediction markets more capital efficient.

If it works, every major prediction market will follow. Because leaving $680 million idle isn't sustainable when DeFi can put it to work.

BIG SHORT TRADER POINTS TO A NEW MARKET TO WATCH 💰

Danny Moses, a trader well-known for his expert forecasting of the Great Financial Crisis, has been talking about prediction markets lately. He believes they can serve as a useful tool for stock investors, and that participants across all forms of investing should be paying close attention.

The idea is pretty simple. Prediction markets like Kalshi or Polymarket don’t give you opinions; they give you probabilities. A contract trading at 35¢ is the market saying there’s roughly a 35% chance something happens. And unlike polls, pundits, or earnings calls, those probabilities update constantly as new information hits.

Moses’s point isn’t telling people to go bet their portfolios. He’s saying that scrolling prediction markets can surface risks and opportunities you might not be thinking about yet. Fed cuts, index additions, crypto downside, regulatory outcomes, and more. Events that can move real assets, sometimes before it shows up in price.

There’s also a practical angle here. For certain scenarios, a prediction contract can be a cleaner way to express a view than options or other derivatives. Limited downside, clear payoff, no Greek gymnastics required.

Of course, these markets aren’t magic. Crowds get things wrong. Narratives take over. Liquidity can be thin. But as a sentiment dashboard and a way to see what money-backed opinions look like in real time, they’re getting harder to ignore.

One of the lessons from 2008 was that the signals were there early. They just lived in places most people weren’t looking.

Prediction markets might be one of those places again.

MARKET MOVES 📈

Metric | Market |

Biggest swing | "Aziz Akhannouch out as Morocco Prime Minister by December 31, 2026?" moved 44% → 84% (Polymarket) |

Top earner | @DrPufferFish - $548,0Pre39 24H profit (Polymarket) |

Weirdest market | "L.A. U-Haul attack perp charged with terrorism?" (Polymarket) |

ODDS & ENDS 📊

Predict.fun now supports USDT and USDC deposits from HyperEVM.

MetaMask prediction markets feature average only 300-400 users per day with $700K in total notional volume after a month of being live.

David Friedberg explains on the All-In podcast that “prediction markets could become not just markets but also news.”

RATE TODAY’S EDITION

What'd you think of today's edition?

MEMES OF THE DAY 😂

A big 2026 starts now. True builders use this stretch of time to get ahead, not slow down. Launch your website with AI, publish a stunning newsletter, and start earning more money quickly through the beehiiv Ad Network. Use code BIG30 for 30 percent off your first three months. Start building for 30% off today.