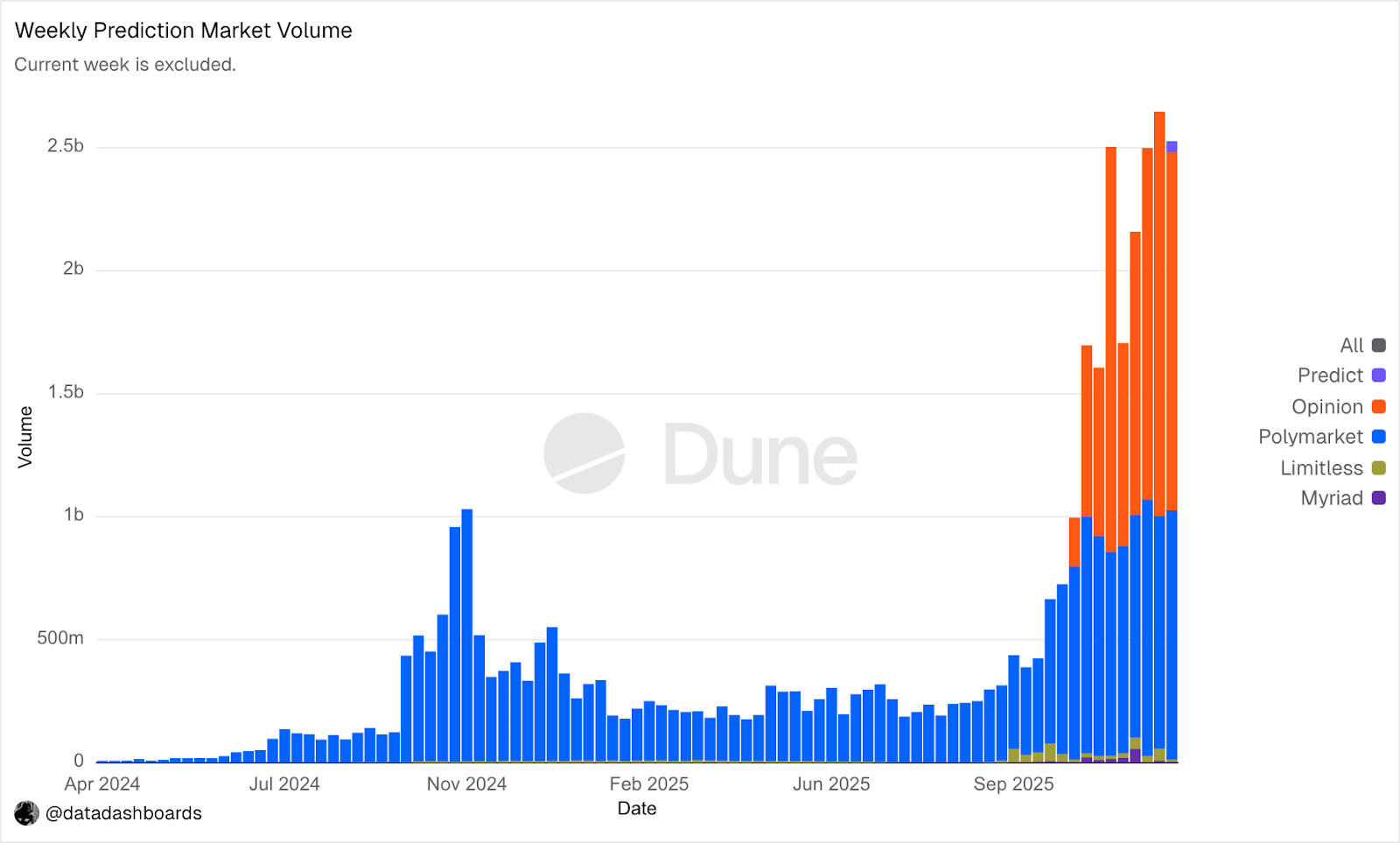

In just 2 months, Opinion.Trade went from launch to beating Kalshi and Polymarket in weekly volume, 100K unique traders using their platform, and over $4 billion of activity on their platform. But what is Opinion.Trade, and where did it come from?

Source: @opinionlabsxyz on X

The Backstory

In 2023, Columbia graduate Forrest Liu founded Opinion Labs in Hong Kong. With experience in corporate finance at CMB international and alongside a team of Citadel and JP Morgan quants, McKinsey strategists, and Bytedance developers, Liu went through Binance Labs’ MVB 7 accelerator in August 2024. Later, they raised a $5 million seed round in March 2025 led by YZi Labs, the venture arm of Binance, which itself was founded by Changpeng “CZ” Zhao. They also received funding from Animoca Ventures, Amber Group, Manifold Trading, and Echo Community.

The Growth

Opinion.Trade started with the thesis that everyday traders should be able to easily trade on the economic events that impact them - inflation, interest rates, employment trends and more. Essentially, Opinion.Trade started with the intention of increasing the accessibility of financial positions that have historically required owning complex financial instruments like futures, bonds, options, instruments that tend to be gated to those with certification or expensive financial advisors.

From Liu: “The next evolution of trading will center on information and macroeconomic data itself, not just financial proxies”.

Even Opinion.Trade brands itself as “the people's terminal for global economic trading”, a platform that can eliminate the barriers that keep retail investors from participating in macro markets.

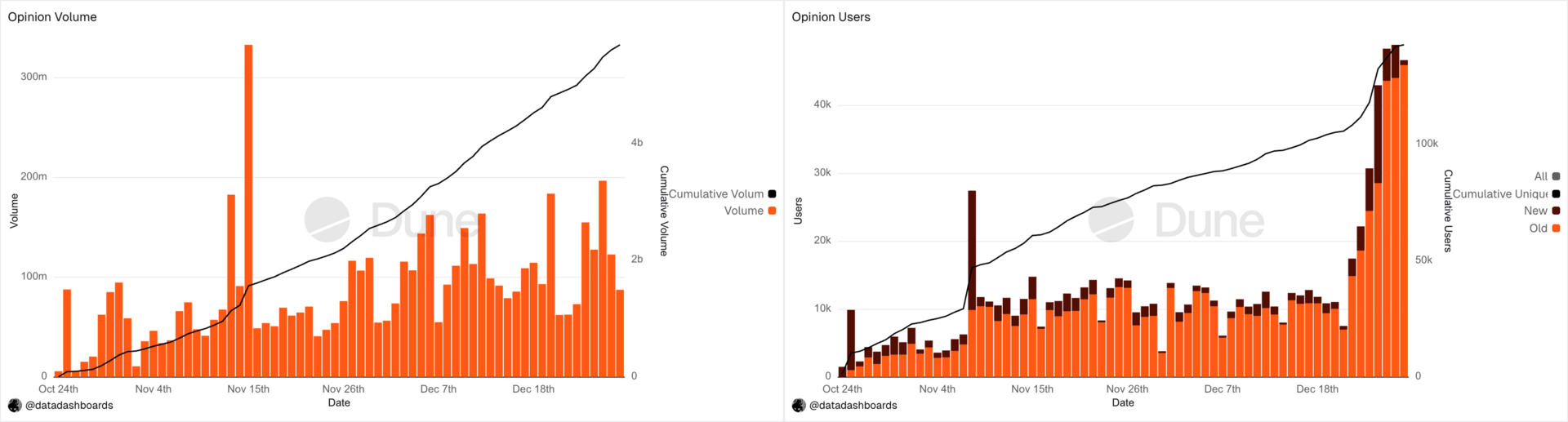

Since then, the growth has been explosive. Within 24 days of its public November 4th launch, the platform has seen over $4 billion of cumulative volume. It went from $11.4 million traded the first day, to hitting a peak daily volume of $651.2 million within its first month.

Not only that, but the platform recently hit 100K unique traders on the platform, with a peak of 71,000 transactions in one day. The platform recently surpassed Kalshi and Polymarket in weekly volume, accounting for 40% market share across all prediction markets. By contrast, Kalshi took second with 32.9% and Polymarket ranked third with 26.6% market share.

How does Opinion.Trade work?

Opinion.Trade utilizes its proprietary “Opinion Stack” architecture, separated into 4 layers.

The top layer of the stack is the prediction market itself, which serves as a live exchange for users to directly interact with its professional-grade Central Order Limit Book.

Opinion AI

The first large-scale use of AI by a prediction market itself, Opinion replaces traditional decentralized oracles with a multi-agent “jury” composed of ChatGPT, Claude, and Gemini to determine the outcome of a market. There’s still humans involved where needed for verification, but the first pass when determining which direction a market settled in is done with AI. Outside resolution, users are also able to use AI to create new prediction markets, enabling the seamless creation of professionally created and defined markets at the request of users.

Opinion Metapool

Still in development, the Opinion Metapool is planning to be a unified liquidity layer for merging fragmented event markets

Opinion Protocol

The Opinion Protocol is planned to be a universal token standard for use within the Opinion ecosystem that enables Opinion.Trade to be chain and platform agnostic.

The fee system favors liquidity providers, with a 0% fee for market makers, but a dynamic fee for market takers which varies between 0-2% based on the market price. The minimum fee is 50 cents regardless of price though. They also have a referral program that offers a 5% rebate on the invitees’ fees plus up to a 10% fee discount for new users.

Because Opinion.Trade is exclusively available on the BNB chain, the platform is able to cover all gas fees for trade matching.

OPN Points

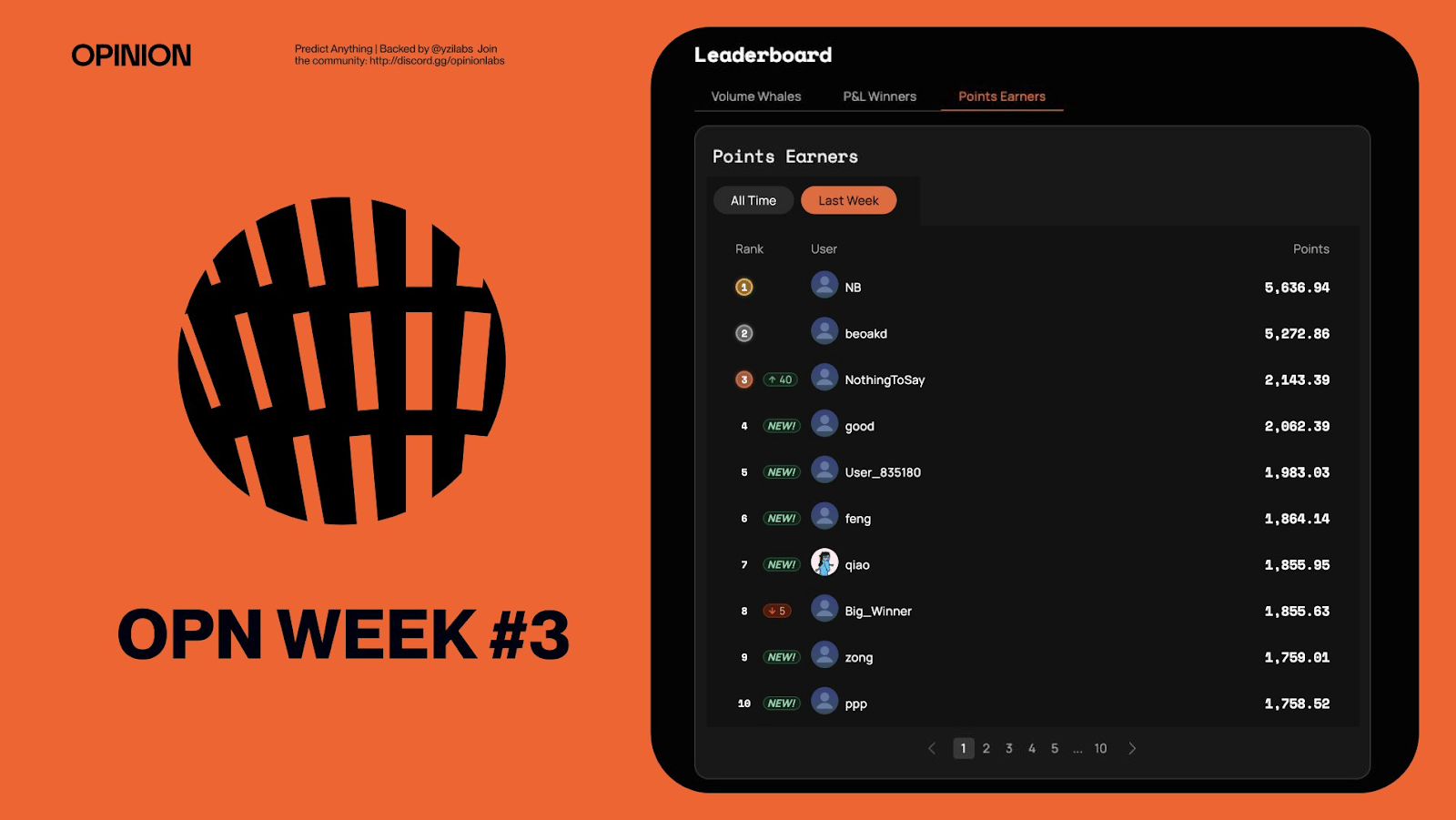

OPN points are a weekly points program held by Opinion Labs for Opinion.Trade users. Every week, the platform distributes 100,000 OPN points, with points guaranteed to users who hit at least $200 in volume that week. While the points aren’t tied to any monetary value yet, it’s been hinted that they’ll be directly tied to a future token launch. No official announcement or details have been released so far, so any incentives tied to OPN points are purely speculative right now.

Source: Opinion.Trade

Frequently Asked Questions

Can I use Opinion.Trade?

Opinion.Trade is available to users outside the U.S.A. Since Opinion.Trade is built on blockchain technology, users are required to have a EVM-compatible wallet like MetaMask and USDT to trade with.

How do I use Opinion.Trade?

If you have an EVM-compatible wallet, you can simply connect your wallet to the platform and start trading.

What are the fees?

If you place a limit order that doesn’t immediately trade, then the fees are 0%. If you place a market order, fees range from 0% to 2% based on the price of the market. There is a $0.50 minimum fee regardless. Opinion.Trade covers gas fees for trade matching. You only pay BNB Chain transaction fees when depositing or withdrawing.

How does it differ from other prediction markets?

Unlike competitors like Kalshi (CFTC-regulated, US only) and Polymarket (crypto-native, built on Polygon), Opinion.Trade focuses largely on macroeconomic events and employs a unique AI-driven architecture for market creation and resolution. It is similar to Polymarket in that it requires cryptocurrency to use, but is less politics and sports focused.