GM. This is PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

👑 New leader emerges in the prediction markets race

🔥 Crypto wallets add prediction trading for millions

💰 Insider profits off Trump x Zelensky news

🎯 Odds & Ends

📈 Market Movers

OPINION BECOMES THE TOP PREDICTION MARKET BY VOLUME 👑

Just when everyone thought no one could dethrone Kalshi and Polymarket in the prediction market race, a new competitor has emerged.

It’s name? Opinion. Launched exclusively on BNB Chain in October this year, the decentralized prediction market has quickly reached $1.43B in weekly notional volume, beating out Polymarket ($1.19B) and Kalshi ($1.34B) this past week.

Source: @datadashboards on Dune

Opinion’s roots stem from YZi Labs (formerly Binance Labs) which awarded them $5M in seed funding. Some view Opinion as a Polymarket copycat, built with almost identical functionality on the blockchain.

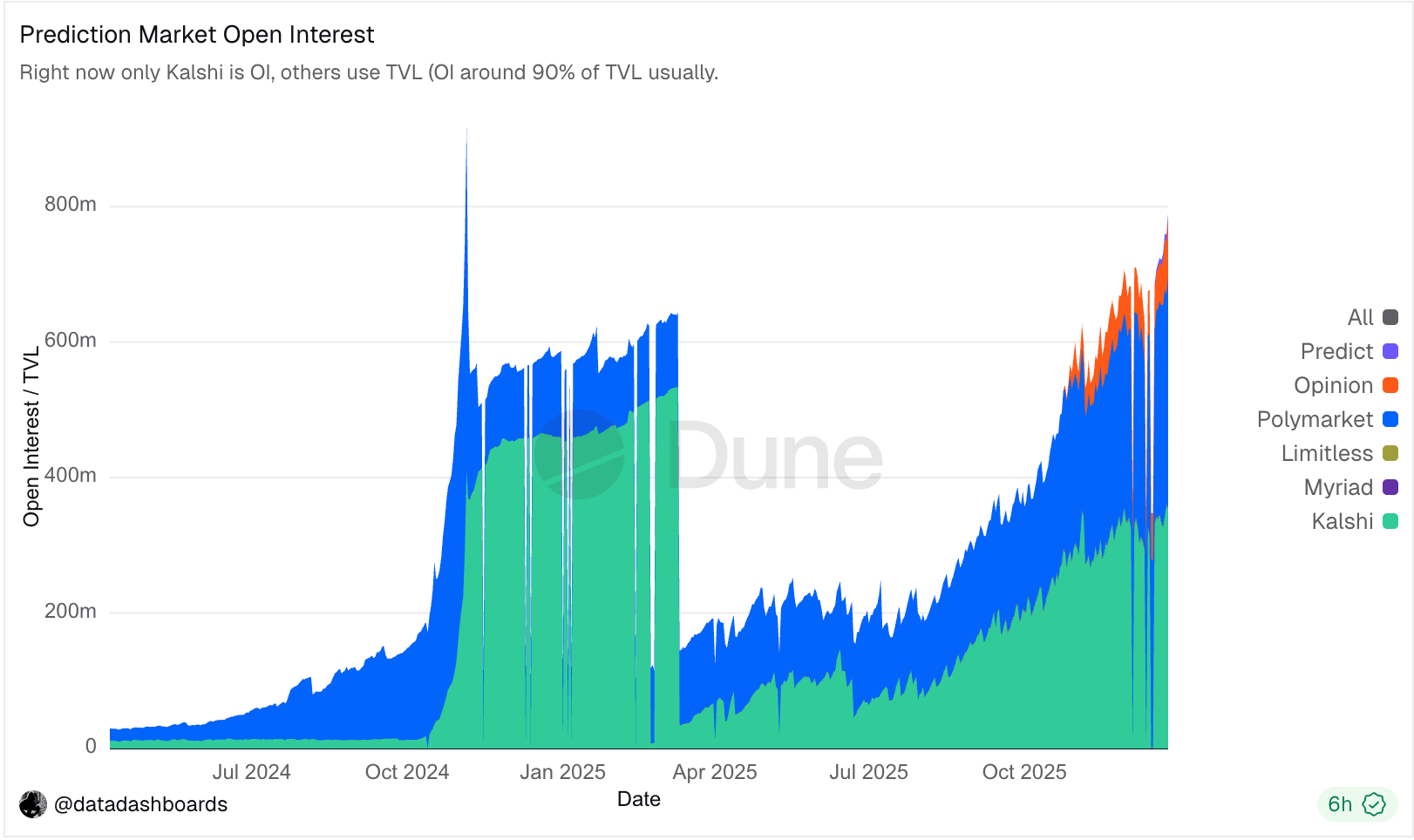

While Opinion may have topped weekly volume charts, some argue that open interest is a better indicator of prediction market performance.

Here’s a simple example to explain the difference:

If you bet $100, then sell that bet to someone else for $110, that's $210 in volume but only $100 is actually at stake (ie $100 in open interest).

In other words volume can easily be gamed or inflated by the same money moving around. Open interest, on the other hand, is the total amount of money currently locked in active bets.

When looking at the open interest numbers on Dec 24 among the three platforms, we notice a different story:

Kalshi: $343M

Polymarket: $332M

Opinion: $72m

Source: @datadashboards on Dune

Zoom out: Opinion’s volume surge is impressive, but Kalshi and Polymarket still hold 5x more capital in committed bets. Only time will tell if Opinion can maintain this momentum, but for now it seems like Kalshi and Polymarket are still in the lead.

Side note: For developers wanting to build on the new exchange, Opinion has opened a builder program with over $1M in grants available.

RAINBOW & SOLFLARE JOIN IN ON THE ACTION🔥

Earlier this week, Rainbow announced their partnership with Polymarket, allowing IOS users to trade on their favorite events in sports, politics, crypto, culture, & more, all natively in their wallets. Today, that privilege was also extended to Android users (yes, they should be able to trade too).

Rainbow isn’t the only wallet allowing its users to predict the future. Today, Solflare announced that they are the newest member in the prediction markets arena, partnering with Polymarket rival Kalshi to allow users to trade natively without fees.

Why should we care? Both are strong signals that indicate prediction markets are moving away from standalone apps to wallet-native experiences. No new onboarding, no need for separate accounts.

No surprise that Polymarket, with its strong crypto-native reputation, partnered with Rainbow to bring mobile trading to a much broader audience. Kalshi’s partnership with Solflare should similarly drive more participation and liquidity across DeFi markets.

More broadly, these partnerships signal something bigger. Prediction markets are no longer niche. They’re becoming part of the mainstream trading experience, with more users, deeper liquidity, and more active markets. We absolutely LOVE to see it. 📈

INSIDERS TRADE TRUMP AND ZELENSKYY 💰

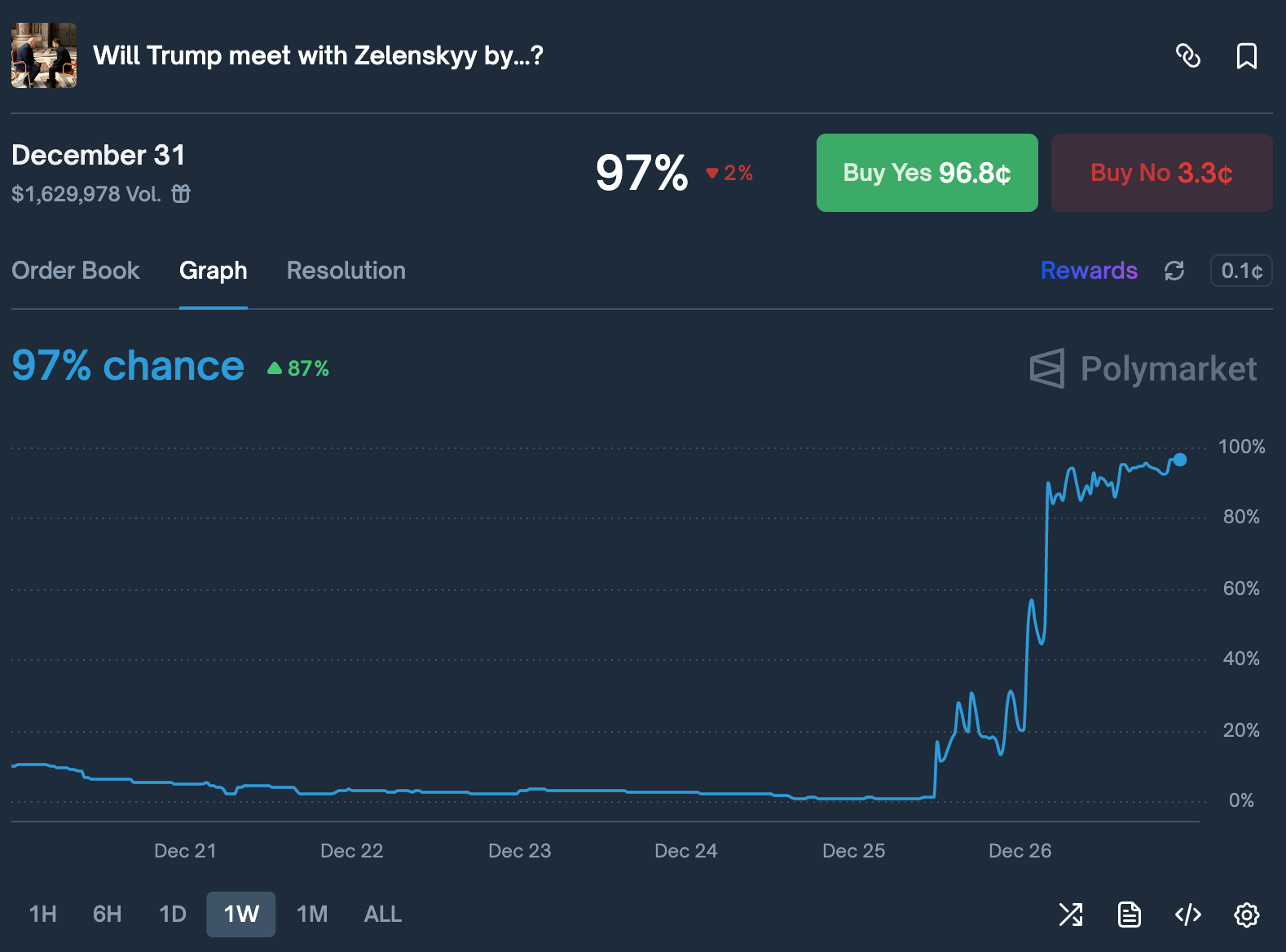

Over the last couple days, three Polymarket accounts pumped the price of the “Will Trump meet with Zelenskyy by Dec 31” market from near 0% all the way to 90%. The catch? No news related to a meeting had been released.

Source: Polymarket

Each account was created only 24 hours before trading, funded with nearly identical amounts (5k, 5k, 4.9k USDC), and placed only on this single market.

After these bets were placed, news broke that Trump is scheduled to meet with Zelenskyy this Sunday. While there's no hard proof of insider trading, these accusations have become increasingly common on prediction markets as prices often surge right before news breaks.

The accounts in question:

A problem to be solved: insiders are a real threat to prediction market fairness. Although they help push markets toward true odds, it comes at the expense of regular traders who don't have access to the same info.

MARKET MOVES 📈

Metric | Market |

Biggest swing | “Will Trump talk to Zelenskyy by Dec 31” moved ~1% → 95% (Polymarket) |

Most traded | "Fed decision in January" - $68.7m total volume (Polymarket) |

Weirdest market with volume | “Clavicular charged by Jan 31?" - $78k total volume (Polymarket) |

ODDS & ENDS 📊

Polymarket trader RN1 turned $1,000 into a $2M+ profit in under 6 months by running a high-frequency arbitrage strategy with 13,000+ trades.

Kalshi briefly went down today, causing users to panic as trading was halted. Delayed payouts caused hesitation in betting from untrusting users.

Opinion hit 100K unique users who’ve traded on their platform, and report 10% daily new user growth - unprecedented for a 2 month old platform.

RATE TODAY’S EDITION

What'd you think of today's edition?

MEMES OF THE DAY 😂

Crypto bros rolling into 2026

@boldleonidas on X