GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

⚖️ The lawsuit that shows how Kalshi really operates

🏦 Earnings season traders look towards prediction markets

🎥 How Polymarket's Golden Globes Partnership Actually Played Out

📈 Market Moves

📊 Odds & Ends

KALSHI'S PLAYBOOK EXPOSED: HOW THE PREDICTION MARKET LOBBIES STATE GOVERNMENTS ⚖️

Kalshi's Tennessee lawsuit just revealed something more interesting than the legal arguments: how the company actually operates behind the scenes.

Here's what happened: Kalshi hired Robert Cooper, who used to be Tennessee's top lawyer (the attorney general), to call up his old office and ask them to leave Kalshi alone. Basically, "Hey, I used to have your job, let's talk before you do anything rash."

His argument? Other states already agreed to sit on the sidelines and wait for federal courts to sort things out. Tennessee should do the same.

Cooper wasn't the only former state official on Kalshi's payroll. Andy Cook, who used to be Wisconsin's second-in-command attorney, was making similar calls.

It's a smart strategy: hire the people who used to run these offices, have them lean on their old colleagues, and hope the relationships do the work.

Tennessee didn't bite. Their response: "I don't have anything to share with Kalshi at this time," said Chief Deputy Attorney General Lacey Mace.

Three days later, the state sent a cease-and-desist. When Kalshi asked if Tennessee would pause enforcement during the lawsuit, the answer was blunt: "We will not be staying enforcement."

The playbook works sometimes. But not in Tennessee, and that's a problem, because twelve U.S. Senators are now asking hard questions about the entire industry.

Senator Catherine Cortez Masto (D-Nev.) led a letter to the CFTC this week demanding answers about insider trading on prediction markets after a fresh Polymarket account dropped $30,000 on Maduro being ousted, just six and a half hours before his capture was announced. That bet turned into $436,000.

The Senators' concern is simple: legal sportsbooks flag suspicious betting to regulators. Prediction markets don't. And when you're betting on military operations and regime changes, someone with inside information isn't just making money - they're potentially leaking national security intel.

Kalshi's state-by-state battles and Polymarket's Maduro trades are two different problems. But they point to the same question regulators are now asking: who's actually watching these markets?

EARNINGS SEASON BRINGS NEW USE CASE 🏦

If you think earnings season is just about revenue beats and misses, you haven’t been watching the markets where people literally put real money on what CEOs will say on conference calls. Welcome to the new frontier of earnings trading.

It started as a whisper on Twitter, a Reddit thread here and there, and now it’s front-page momentum. Prediction markets like Kalshi and Polymarket aren’t just playgrounds for memes and political nonsense anymore. They’re becoming actual tools for traders to price the future in a way stocks and options never could.

Forget traditional betting on whether a company beats earnings estimates. Today, you can wager on things like whether a CEO will mention “hot dog” during an earnings call and make 2.5x on $170 because he did.

Stocks don’t move in predictable ways after earnings. Sometimes a beat sends a stock down, sometimes a miss sends it up. So pricing that volatility with options is messy at best. Prediction markets, by contrast, offer a simple yes/no binary contract that says: “Do you think Spotify’s monthly active users will hit X this quarter? Yes or no.”

This binary simplicity turns blue-sky speculation into dollar outcomes that reflect collective belief, not analyst estimates plastered on Bloomberg terminals.

Enter mention markets. If betting on earnings beats is one thing, then mention markets are a whole different beast. In these markets you literally bet on whether specific words like “growth,” “guidance,” or “hot dog” get spoken during earnings calls. That’s a level of granularity that makes traditional traders go cross-eyed.

The narrative here is simple. Earnings calls are scripted, but not that scripted. One off-hand phrase can swing sentiment. Traders are now trying to profit from the language itself.

Volume and credibility still lag. While sports and politics light up the prediction markets like fireworks, earnings bets barely move the needle. One Polymarket contract around Jefferies’ earnings beat drew just over $37,000 in volume, peanuts compared to millions wagered on other topics.

That’s the tell. Liquidity is the lifeblood of a real market. Thin books = whipsaw pricing. And without volume, these earnings bets risk looking like glorified gambling rather than informative signals.

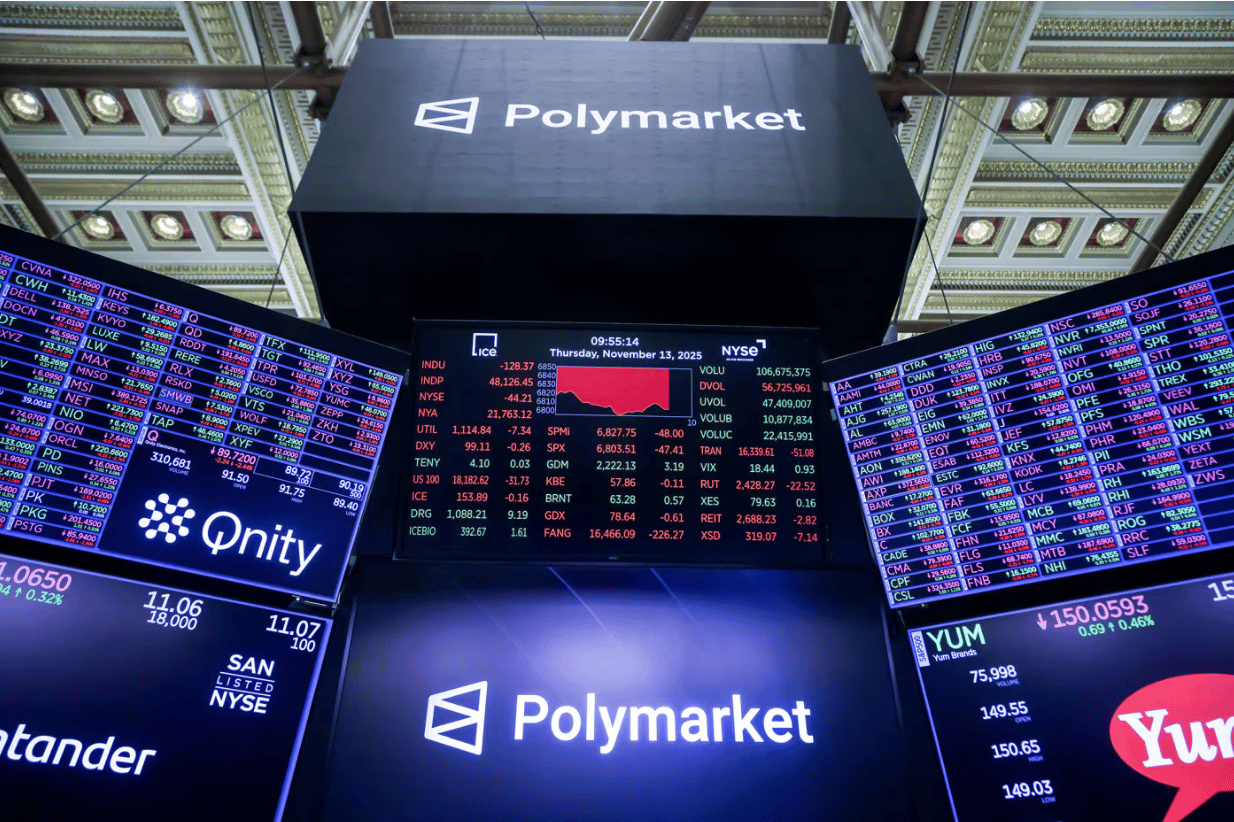

Institutional interest isn’t vaporware. The New York Stock Exchange’s parent company, ICE, sunk billions into Polymarket, and mainstream brokers like Robinhood now offer Kalshi contracts.

However, legitimate concerns still swirl around manipulation, low volume, and the sneaky psychological influence these markets could exert on retail sentiment.

Here’s the crux. Prediction markets are cool: real-time probability pricing, crowd insights, multi-domain forecasting. They’re not yet reliable financial instruments: especially for something as nuanced as earnings.

Market pioneers still smell opportunity. Instead of just betting on headlines, traders are beginning to treat these contracts as alternative risk tools, almost like micro-options on future corporate behavior.

WHEN AWARD SHOWS GET ODDS 🎥

Polymarket's debut as the Golden Globes' official prediction market partner went exactly as well as you'd expect. Sunday's CBS broadcast featured announcers teasing categories with Polymarket odds flashing on screen, turning an awards ceremony into something resembling ESPN's pregame coverage. The platform ended the night with a 96% hit rate, correctly calling 26 of 27 categories from a pool of $2.5M in wagers.

The lone miss: Hamnet won Best Motion Picture - Drama after Sinners had traded at 57% odds. Going 26-for-27 is impressive, but it's also the kind of accuracy that reignites questions about insider trading on these loosely regulated platforms.

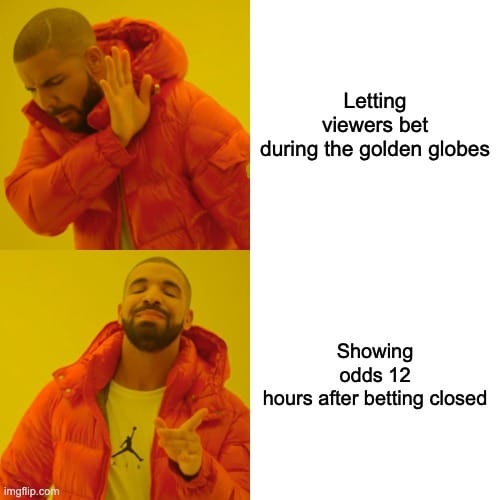

The on-screen prompts missed one key detail: betting had actually closed at 7:00 am that morning. For the millions watching at home, the integration was effectively a branding exercise rather than a live betting opportunity. This disconnect drew sharp criticism from viewers, who described the "gambling funnel" aesthetic as intrusive - especially for a market they couldn't participate in. Penske-owned outlets (Variety, Deadline, THR) ran real-time ticker coverage and sponsored posts, which only added to the backlash.

The Academy Awards are two months out and haven't announced a similar deal, but Polymarket already has 22 Oscars polls live with volumes ranging from $112K to $8M. We’re about to find out if this Sunday was just a one-off experiment or the new norm for award shows.

MARKET MOVES 📈

Metric | Market |

Biggest swing | "Will Pam Bondi be the first to leave the Trump Cabinet?" moved 5% → 34% (Polymarket) |

Top earner | @0x492442eab586f242b53bda933fd5de859c8a3782 - $846,152 24H profit (Polymarket) |

Weirdest market | "Who is Bad Bunny’s halftime opener" - $3,104 total volume (Kalshi) |

ODDS & ENDS 📊

Prediction market trader turns $100 into $4,923 by specializing in weather markets, generating nearly $20,000 in total winnings across 2,068 predictions.

Manifold launches Predictle, a Wordle-style daily puzzle game for prediction markets where players sort events by probability in as few guesses as possible.

Polymarket and devfun launch "Tribunal," a live Shark Tank-style competition for prediction market projects with a $10,000 prize on January 22, 2026.

RATE TODAY’S EDITION

What'd you think of today's edition?

MEME OF THE DAY 😂

Stop planning. Start building. With beehiiv, this the end of the year is a great time to get ahead. Build a website with AI, launch a newsletter in minutes, and start earning through the Ad Network. Use code BIG30 for 30 percent off your first three months. Start building for 20 percent off today.