GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

⛓️ Kalshi's Solana launch is flopping

💸 Why your prediction market taxes are better than you think

🤖 AI bots are trading against you now

🎯 Odds & Ends

📈 Market Movers

KALSHI LOOKS TO SOLANA FOR GROWTH ⛓️

Earlier this month, Kalshi made what seemed like a smart move: they launched on Solana, letting users trade on the blockchain for the first time. Everyone, myself included, thought this would be what Kalshi needed to pass Polymarket and become the undisputed leading prediction market.

I was wrong.

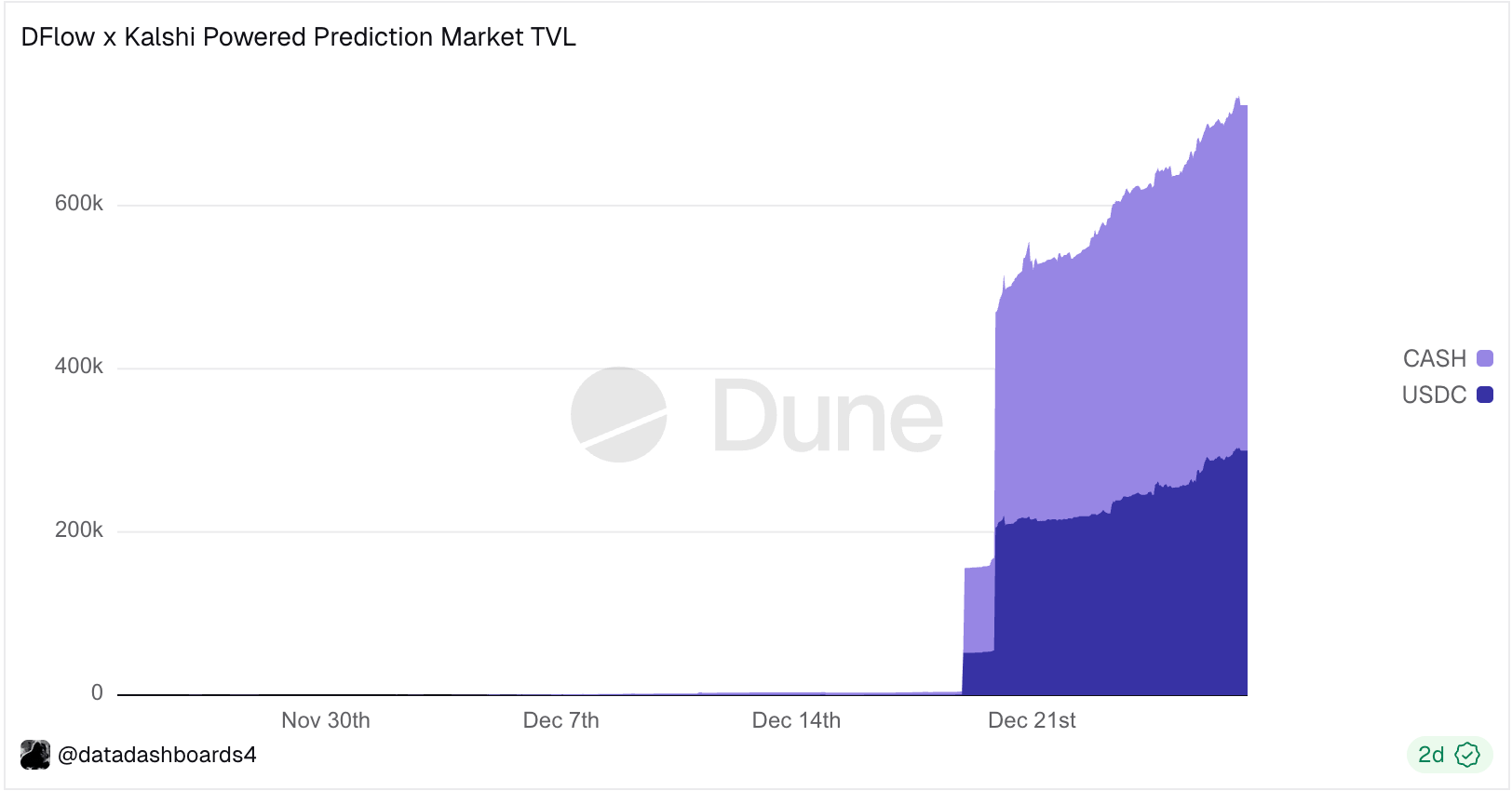

So far, the data below shows just $723K in new money flowing into Kalshi's markets on Solana, a tiny fraction of their $340M+ in total bets.

Source: @datadashboards on Dune

Most of that came in the form of Phantom wallet's CASH stablecoin, likely driven by Phantom adding prediction market trading directly into their wallet. Regular USDC trailed behind.

To be fair, it's only been a month. Adoption takes time.

Zoom out: Polymarket, Kalshi's biggest competitor, runs entirely on the blockchain, meaning almost anyone in the world with a crypto wallet can trade, no annoying KYC required. Kalshi hoped they’d be able to compete for that international market but the early numbers suggest it's not gaining traction just yet.

Maybe this changes in six months. I think it will. Either way, we’ll be watching.

PREDICTION MARKETS = LOWER TAXES? 💸

Here's something nobody told you: prediction markets might have the best tax treatment of any form of betting in America.

According to a new Barrons analysis, your Polymarket and Kalshi winnings aren't taxed like sports betting or gambling. They're taxed like futures contracts.

Okay, what does this mean?

Sports betting and gambling winnings are taxed as ordinary income at your regular tax rate (which for most people is 22%-37%).

Prediction market earnings, however, fall under Section 1256 of the tax code, which uses a blended rate:

60% taxed as long-term capital gains (~15%-20%)

40% taxed as short-term capital gains (your ordinary rate, ~22%-37%)

Do the math and your effective rate is roughly 20%-28%, much lower than the 22%-37% you'd pay on traditional sports books.

In other words, DraftKings and Fanduel are more cooked than we thought.

THE ROBOTS ARE BETTING NOW (AND THEY'RE WINNING) 🤖

Word on the street is that traders are now letting their bots do the heavy lifting on platforms like Kalshi and Polymarket. These are full-on AI agents making trades, analyzing odds, and stacking profits while their owners binge Netflix.

The discussion is getting spicy. Traders are swapping strategies, sharing results, and basically creating an underground league of AI traders competing against each other. It's like Fantasy Football but with robots and real money.

This changes everything. Remember when prediction markets were just for politics nerds and crypto degens? Yeah, those days are over. Now you've got AI running 24/7, never panicking, never getting emotional, just cold, calculated betting based on pure data.

Agents don't need coffee breaks. They don't FOMO into bad trades. They just execute. Perfectly. Repeatedly.

And with wallet integrations making everything seamless, we're basically watching the birth of autonomous financial agents. Your wallet doesn't just hold your money anymore; it's actively making you money while you sleep.

We're living in the future, folks. And the future is automated.

MARKET MOVES 📈

Metric | Market |

Biggest swing | “Will Trump talk to Ursula von der Leyen” moved ~6% → 100% (Polymarket) |

Most traded | "LA Rams at Atlanta Falcons" - $1.24m total volume (Kalshi) |

Weirdest market with volume | “Will anyone be charged over Daycare fraud in Minnesota?" - $190k total volume (Polymarket) |

ODDS & ENDS 📊

Polymarket users complain about site issues, traders’ wallets taking hits

Limitless doubles down on soccer and sports markets as a whole

Kalshi crosses over 100M cumulative transactions on their platform

RATE TODAY’S EDITION

What'd you think of today's edition?

MEME OF THE DAY 😂

@systematicls on X