GM. You’re reading PredictionDesk, the daily newsletter that helps you become a prediction markets expert in under 5 minutes.

Here’s what we got for you today:

👑 a16z bets big on prediction markets

🔋 Market-specific UI’s give traders new edge

💰 The man who paid the homeless to predict mergers

🎯 Odds & Ends

📈 Market Movers

a16z CRYPTO: PREDICTION MARKETS ARE HERE TO STAY 👑

Every year, a16z crypto (the crypto arm of venture capital mega-giant Andreessen Horowitz) releases their "Big Ideas" list, a forecast of the trends they expect to define the coming year. And this year, they dedicated an entire page to a bold claim: 2026 will be the year prediction markets go bigger, broader, and smarter.

Source: a16z crypto

If you've been paying attention, this shouldn't surprise you. We watched prediction markets go from a niche curiosity to front-page news during the 2024 election cycle. Polymarket alone was pulling $500 million in weekly volume. Fast forward to today, and the industry has multiple giants competing for over $5 billion in weekly volume. That's 10x growth in a year.

But here's what's interesting: a16z isn't just betting on more election markets. They're betting on prediction markets becoming something closer to a global information layer, where you can access real-time odds on everything from geopolitical events to obscure, in-the-weeds outcomes that would have never warranted a market before.

Andy Hall, a Stanford professor and a16z crypto research advisor, put it this way: prediction markets don't replace polling; they make polling better. The two systems can work in concert, with AI improving the survey-taking experience and crypto providing new ways to verify that respondents are actual humans and not bots.

The real unlock, though, might be something a16z calls "staked media." In a world where AI-generated misinformation is getting cheaper to produce and harder to detect, prediction markets offer something increasingly rare: a source of truth with skin in the game. When real money is on the line, bad information gets expensive fast. You can spin up a thousand AI-generated articles pushing a false narrative, but you can't fake your way through a market where people are betting actual dollars on outcomes. The fee structure and financial stakes act as a natural filter against the noise.

Check out the full a16z article here.

VERTICALIZED FRONTENDS UNLOCK TRUE MARKET POWER 🔋

First, if you’re wondering what the heck is a verticalized frontend? In simple terms, it’s a market-specific UI.

Example: A user betting on election outcomes may want a single platform where they can trade markets and view all relevant polling data for each race in one place.

Prediction markets are fast, expressive, and brutally honest in a way most analytics tools never are. However, great market infrastructure often gets wrapped in interfaces that treat every question as interchangeable, flattening something powerful into something merely functional. Traders desperately need more industry-specific UI’s to properly conduct analysis.

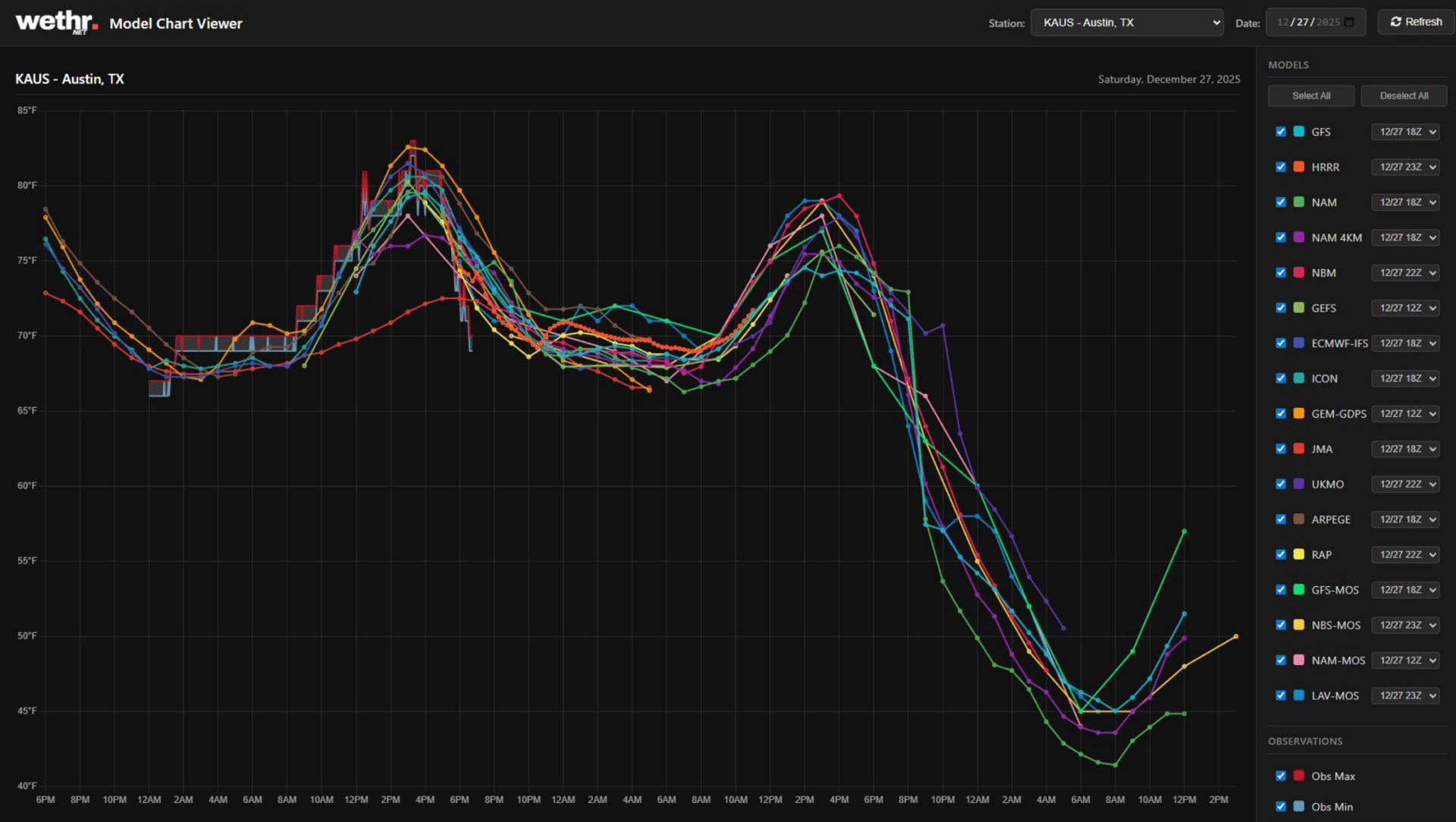

That’s where verticalized frontends get exciting. For example, if you as a trader want to primarily bet on markets about the weather, such as “What will be the temperature in LA tomorrow,” a verticalized weather frontend may cover every weather station, add additional stats useful for the trader, and ship tools like Wethr.net’s Model Viewer. These tools help you and other weather market traders make more informed decisions and ideally more profitable trades.

The optimistic takeaway is that prediction markets aren’t early anymore, they’re just early in their interface era. Verticalized frontends don’t compete with them, they unlock them. As these tools get more specialized and advanced, prediction markets start to feel less like experiments and more like default infrastructure for understanding the future. And once that clicks, it’s hard to imagine going back.

It’s clear that the market wants people to build this infrastructure. We say it’s time to build.

THE MOST INTERESTING TRADER ISN’T USING PREDICTION MARKETS (YET) 💰

I spent an hour yesterday reading about a man named Chris DeMuth. Most people probably don't know him, I didn't either, until I came across his recent interview with Polymarket.

"Alpha." It's what every trader wants in a prediction market: knowing more than others and spotting a mispriced bet.

Chris is the definition of alpha.

He's paid homeless people to stake out government buildings to see whose lights were on. He's used FOIA requests to get early intel on contracts. He's called Senate offices and embarrassed senators into finding out what they should already know about deals in their state.

Why? To predict merger outcomes and regulatory decisions before anyone else.

Here's the thing: DeMuth doesn't use Polymarket or Kalshi. He can't. The things he wants to bet on, such as merger outcomes, regulatory approvals, corporate contingencies, aren't on these platforms yet.

DeMuth's research approach is simple: call the top person directly. CEOs and founders have no boss to fear. They'll either talk or they won't. But first, get 60-70% informed from SEC filings. Then call to fill the gaps.

When they pick up, open with: "You don't owe me an answer." Suddenly they're not defensive, they're the person deciding whether to help.

Then present your educated guess and watch their reaction.

Zoom out: Prediction markets today are stuck on simple yes/no bets: Who wins the election? Does Team A win? The real opportunities, where research actually matters argubaly, don't exist yet.

Example: A company buys a Guatemalan silver mine, but the deal only pays out if indigenous tribes approve it. And those tribes consult spiritual leaders before deciding.

You can't bet on that outcome anywhere. But someone who researches the tribal politics and talks to the right people? They'd have a massive edge. That's where real alpha lives. Not "Will Trump tweet today?" but complex outcomes where information matters.

Prediction markets aren't offering many of those bets yet. Until they do, the smartest researchers can't use them.

MARKET MOVES 📈

Metric | Market |

Biggest swing | “U.S. anti-cartel strike/operation on foreign soil by December 31?” moved ~6% → 99% (Polymarket) |

Most traded | "Super Bowl Champion 2026" - $639.1m total volume (Polymarket) |

Weirdest market with volume | “Will anyone be charged over Daycare fraud in Minnesota by...?" - $374k total volume (Polymarket) |

ODDS & ENDS 📊

Check out our new ecosystem page! Explore trade terminals, analytics platforms, and all the projects building in the prediction market space.

Skywork AI releases “The AI Engineer’s Guide to the Polymarket MCP Server”.

Helius CEO sees prediction markets defining Solana’s 2026 growth.

RATE TODAY’S EDITION

What'd you think of today's edition?

MEME OF THE DAY 😂

@boldleonidas on X